An analysis of Malta’s economic conditions resulted in a mxied bag of results as business activity and economic confidence fell despite a return to more normal levels of inflation.

In the latest economic update released by the Central Bank of Malta, it noted that annual growth in business activity also remained slightly below its long-run average in April.

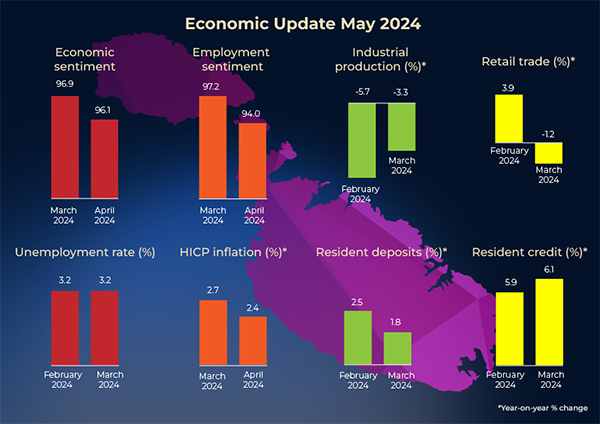

So did the European Commission’s economic confidence indicator, as well as the employment expectations indicator.

Meanwhile, somewhat strangely, month on month price expectations increased among consumers, and to a lesser extent in the retail and services sectors, even though inflation fell to its lowest rate since July 2021.

Price expectations also decreased significantly in the construction sector and to a lesser extent in industry.

Developments in activity indicators were mixed. In March, both industrial production and retail trade contracted on a year earlier. However, unemployment remained low from a historical perspective.

Residential permits were higher in March compared with their year-ago level, and in April, the number of residential promise-of-sale agreements and the number of final deeds of sale rose on a year earlier.

2023 was notable in that the number of final contracts of sale of residential property was markedly lower than it was in 2022, although the number of promise of sale agreements signed was consistently higher.

The expectation now is that 2024 will prove to be a strong year for real estate as the promise of sale agreements signed last year come to contract.

During the 12 months to March, Maltese residents’ deposit increased due to higher balances belonging to households and non-financial corporations. The annual rate of change moderated compared to February.

By contrast, credit to Maltese residents increased at a slightly faster pace compared with a month earlier.

In March, the Consolidated Fund recorded a lower deficit compared to a year earlier.

Two years since its birth, Moneybase features on Microsoft’s Customer Stories

Moneybase has now just been featured on Microsoft’s latest Customer Stories

Finance Minister confirms continuity of food and energy subsidies

Spending on food and energy subsidies as a percentage of the GDP will be at 0.7% in 2025

MHRA congratulates Glenn Micallef on EU role, highlights positive impact on Malta’s tourism and cultural sectors

The lobby group emphasised that Malta’s cultural assets and sports scene are key factors in attracting visitors and fostering economic ...