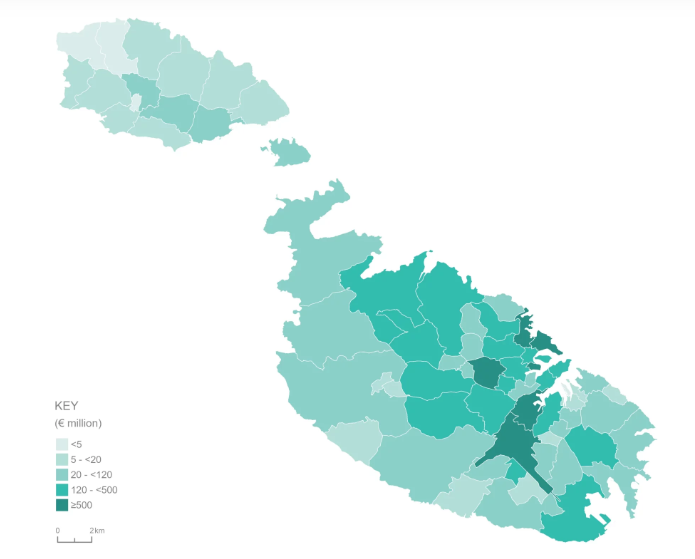

Firms with a registered address in Birkirkara, St Julian’s and Sliema generated the largest aggregated amounts of income in 2022.

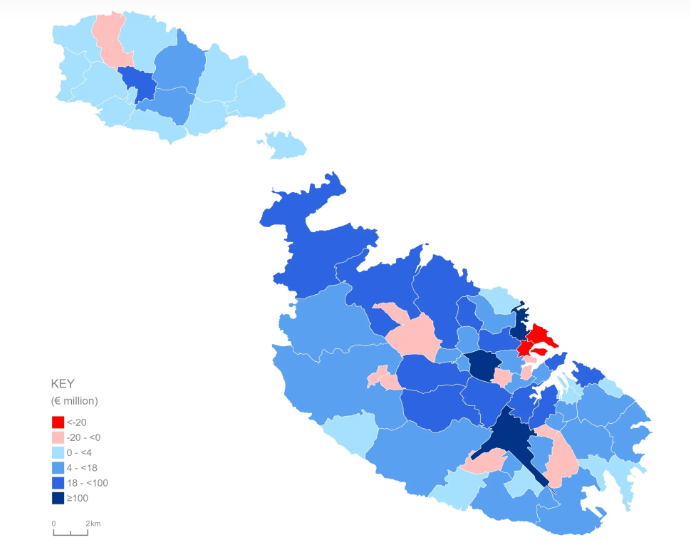

However, while Sliema actually registered a major drop in the total aggregate revenue generated by companies based there (a decrease of over €20 million), both Birkirkara and St Julian’s, joined by Luqa, saw massive increases in the total aggregate revenues generated, of more than €100 million.

The footprint of large enterprises is allocated to the registered address of their respective headquarters, even if they operate through branches across various localities.

Birkirkara, it must be noted, includes the Central Business District in Mrieħel.

The information emerges from a National Statistics Office release that also sheds light on the relation between company size and their profit-wages ratio, and the renewed intensity of investment seen in 2022, when the COVID-19 pandemic was fast receding.

Last month, BusinessNow.mt reported other insights emerging from the report, including the total profit generated by the local non-financial business sector and a sectoral breakdown of revenues and investments.

Turning to the performance of large enterprises, the NSO noted that their number increased by 24 business units in 2022, when compared to 2021.

For the same period, the number of employees increased by 10.2 per cent while the employee benefits expense increased by 15.1 per cent.

Meanwhile, gross investment in tangible non-current assets by large enterprises increased from €6850 million to €1.8 billion – close to tripling in value.

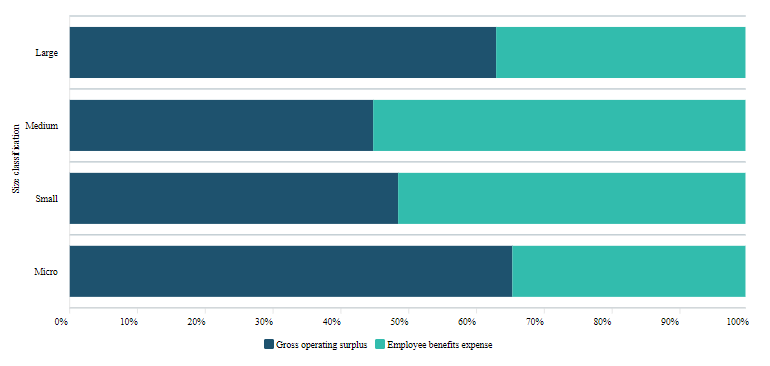

Interesting insights also emerge about the link between company size and income, profits and wages.

While micro and large enterprises posted higher profitability, small and medium enterprises registered a larger share of their income going to employee remuneration (including taxes and social security contributions).

Two years since its birth, Moneybase features on Microsoft’s Customer Stories

Moneybase has now just been featured on Microsoft’s latest Customer Stories

Finance Minister confirms continuity of food and energy subsidies

Spending on food and energy subsidies as a percentage of the GDP will be at 0.7% in 2025

MHRA congratulates Glenn Micallef on EU role, highlights positive impact on Malta’s tourism and cultural sectors

The lobby group emphasised that Malta’s cultural assets and sports scene are key factors in attracting visitors and fostering economic ...