The European economy’s “stagnation” has remained unchanged in 2023’s last quarter with a consistent GPD in Q4, following a 0.1 per cent contraction in Q3.

These observations were made in EY’s latest report on the European economic outlook for January 2024. The report, prepared by the EY Economic Analysis Team and led by Marek Rozkrut – Chief Economist for Europe and Central Asia, includes macroeconomic forecasts for European countries and selected major economies.

It makes the case that stagnant economic growth was caused by numerous factors including “suppressed real incomes, weak international demand and tightening of monetary policy.”

The report noted that despite a decrease in inflation, prices were still high, keeping wages well below their peak and limiting growth in consumption.

“While the cycle of monetary policy tightening has concluded, high interest rates continue to filter through to debt servicing costs and credit conditions, constraining consumer spending and business investment particularly were linked to the housing sector,” the report said.

EY added that within the European and global context, consumers are spending more money on services rather than goods. This has led to subdued demand for both domestic and external demand for goods, which in turn has limited manufacturing activity.

The report highlighted that such circumstances arise at a point when European producers are facing reduced international competitiveness caused by a “stronger-than-elsewhere” increase in energy prices.

In addition, the report remarked that the situation “could have been bleaker if not for the resilience of the labour market and investment.” Adding that the stability can be attributed to high corporate profits and investment needs related to supply chain restructuring, energy and digital transition.

“Concurrently, employment continues to grow, although at reduced rates, while unemployment has stabilised close to historical lows in most countries. This has prevented a pullback in consumer spending, as companies have been hesitant to lay off workers due to structural shortages,” the report reads.

Further supporting the assertion that manufacturing has faltered, it was reported that countries in Southern Europe and the Balkans have continued to outpace those in manufacturing-heaving Central Europe such as Germany, Austria and Czechia.

Nordic countries have also faced challenges, and “under performed” due to their high sensitivity to interest rate hikes, fallout from the war in Ukraine and a slowdown in the pharmaceutical industry.

On the other hand, both Poland and Hungary have begun to experience a recovery, driven by a combination of rapidly decreasing inflation and robust wage growth, which has boosted real incomes and therefore increasing consumption.

Despite stabilisation, EY is expecting European economy to recover slowly throughout the year as real incomes increase, activity in global manufacturing normalises and the drag from tight monetary policy slowly fades with help of rate cuts and government investment, “that continues to support economic activity.”

Nevertheless, the report explains that due to a relatively weak performance in the second half of 2023 and only a gradual recovery in quarterly GDP growth, it anticipates an annual average growth to accelerate only marginally in 2024 to 0.8 per cent (vs its 1.1 per cent forecast in the October outlook), from an estimated 0.5 per cent in 2023.

This “is significantly below the potential growth rate. The recovery is expected to reach full speed in 2025, with growth accelerating to 2.1 per cent vs a 1.5 per cent forecast in October.”

It is also anticipating Poland and Hungary as the standout performers in 2024 with growth rates above three per cent, while simultaneously forecasting a decrease in its investment growth due to the end of the EU-funded Multiannual Framework.

EY is also forecasting inflation to reach two per cent by spring, “and subsequently fall slightly below this level. Concomitant to this, core inflation is expected to drop to 2.5 per cent in 2024 Q2 from 3.4 per cent in December 2023, but may linger slightly above 2 per cent until mid-2025, given the persistent pressure on prices in services.”

“Disinflation has finally encompassed services, while both headline and core inflation have surprised to the downside in recent months.”

It is also expecting disinflation in the food, core goods and services components to continue in the coming months, while energy inflation is set to rise.

It is forecasting that inflation rates for food and core goods will drop below two per cent by mid-2024 as the impacts of previous shocks start to diminish. However, potential disruptions to Red Sea shipping “constitute an upside risk to this forecast.” On the other hand, energy inflation is set to rise.

Overall, it noted that the highest inflation rates continue to be seen in Central and Eastern European countries. Lowest inflation rates below one per cent are observed in the Netherlands, Italy, Denmark and Belgium.

EY also highlighted that there is considerable uncertainty regarding the effects of monetary policy and the time it takes for these effects to materialise which in turn it “may prove to be stronger and more delayed than currently expected.”

“As a result, the downturn in manufacturing and stagnation in world trade may continue longer than anticipated, leading to sub-trend economic growth and reduce demand. This, in turn, could trigger an increase in job losses and unemployment, further slowing economic activity,” the report said.

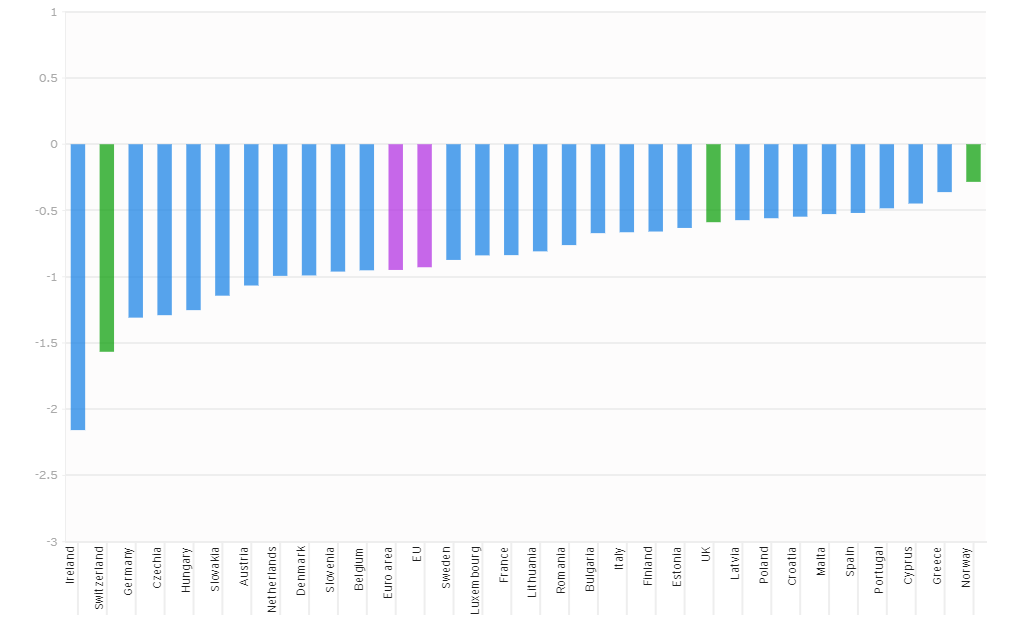

The report estimates that if global trade stagnates throughout 2024, growth in euro area GDP will be 0.4 pp lower than the baseline scenario in 2024 and 2025. While Switzerland, Germany, Czechia and Hungary will be among those most affected Southern European countries will be least impacted, this includes Malta.

EY remarked that ultimately, geopolitical tensions continue to pose a downside risk. An increase in tensions in the war in Ukraine, conflict in the Middle East and the strained China-Taiwan relations may generate spikes in commodity prices, further increase shipping costs, and create renewed bottlenecks in world trade. “This might precipitate a renewed increase in inflation and adversely affect global economic activity.”

Consequently, energy and food prices might also rise due to unfavourable weather conditions or local political unrest.

However, the report ends that there are factors posing an upside risk. While Disinflation may continue faster than expected the rebound in consumption may also outstrip current expectations.

“With improving sentiment and declining interest rates, European consumers may decide to utilise some of their substantial excess savings accumulated during the pandemic. This would result in stronger GDP growth.”

ECB lowers key interest rates by 25 basis points in response to inflation outlook

While inflation remains high, the ECB projects it will ease in the second half of next year

HSBC Malta share price drops sharply following strategic review announcement

Market analysts suggest that the uncertainty surrounding the review, with speculation of an impending sale, has fuelled investor concerns

‘This is true one-touch implementation designed with SMEs in mind’ – Roderick Farrugia, CIO, Melita Limited

A walk through the primary cybersecurity threats facing today’s SME’s and Melita’s practical solutions to combat them