The European Central Bank has indicated that purchases of eurozone debt would accelerate in a bid to shore up Europe’s sluggish economy.

In a statement delivered on Thursday after a meeting of the Governing Council, the European Central Bank (ECB) said that it expects to conduct purchases under a €1.85 trillion bond-buying program at a significantly higher pace than has been the case over the last months.

The ECB also left its key interest rates unchanged.

The decision marks a divergence from that taken by the Federal Reserve, the United States’ central banking system, which recently signalled that it would not seek to stem a rise in Treasury yields.

A strong recovery in investor sentiment around the world has been pushing up global borrowing costs, creating a headache for ECB officials, who are worried that an excessive increase in household and business financing costs could undermine Europe’s recovery before it begins.

ECB president Christine Lagarde (pictured above) said that following the strong rebound in growth in the third quarter of 2020, euro area real GDP declined by 0.7 per cent in the fourth quarter.

“Looking at the full year, real GDP is estimated to have contracted by 6.6 per cent in 2020, with the level of economic activity for the fourth quarter of the year standing 4.9 per cent below its pre-pandemic level at the end of 2019.”

She said that continued economic weakness in the first quarter of 2021 driven by the persistence of the pandemic and the associated containment measures will likely lead to another contraction in GDP.

The ECB’s projected economic growth in the eurozone is 4 per cent in 2021, 4.1 per cent in 2022, and 2.1 per cent in 2023.

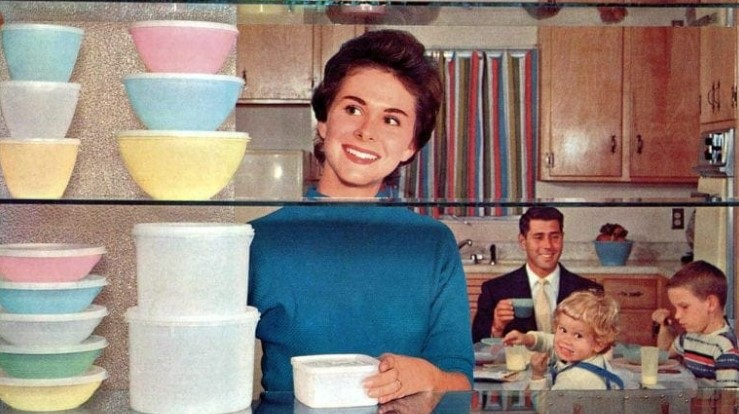

American icon Tupperware files for bankruptcy

The company has faced a decline in sales over recent years

ECB lowers key interest rates by 25 basis points in response to inflation outlook

While inflation remains high, the ECB projects it will ease in the second half of next year

HSBC Malta share price drops sharply following strategic review announcement

Market analysts suggest that the uncertainty surrounding the review, with speculation of an impending sale, has fuelled investor concerns