According to a Eurostat report Thursday, the volume of retail trade in the Euro area dropped by 6.1 per cent in November. This comes despite relatively stable levels of inflation.

Following the re-imposition of COVID containment measures by several European countries experiencing exploding COVID rates, retail trade by volume sank again, undoing some of the progress made during the summer rebound.

The hardest hit sectors were textiles, clothing and footwear, and automotive fuels, that saw declines of 27.8 and 18 per cent respectively as countries, including Britain and Italy, introduced lockdowns of varying types and harshness, confining many citizens to their homes – off the road and out of shops.

Malta avoided the downturn, seeing retail trade volumes climb 1.8 per cent. This is not the first time Maltese financial indicators have outperformed those of its EU partners this week. On Tuesday BusinessNow.mt reported that Malta was one of only three EU countries to record an annual rise in industrial producer prices.

The countries that experienced the sharpest decline in retail trade volume were France (-18.0 per cent), Belgium (-15.9 per cent) and Austria (-9.9 per cent).

Predicted annual inflation in the EU is expected to have remained stable at -0.3 per cent in December. Food, alcohol and tobacco is expected to have experienced the highest level of inflation, at 1.4 per cent. On the other end of the spectrum, annual inflation in the energy sector is expected to have sunk 6.9 per cent in December, though this is an improvement on the November level when inflation in the sector declined 8.3 per cent.

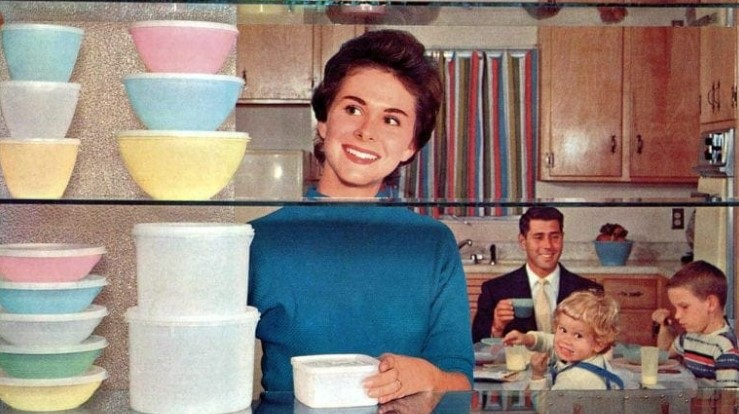

American icon Tupperware files for bankruptcy

The company has faced a decline in sales over recent years

ECB lowers key interest rates by 25 basis points in response to inflation outlook

While inflation remains high, the ECB projects it will ease in the second half of next year

HSBC Malta share price drops sharply following strategic review announcement

Market analysts suggest that the uncertainty surrounding the review, with speculation of an impending sale, has fuelled investor concerns