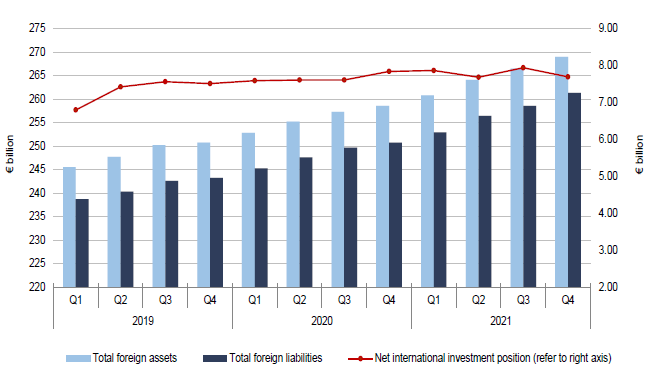

Malta’s net international investment position increased by €10.4 billion in 2021, while total foreign liabilities increased by €10.6 billion, resulting in an overall decrease in the Net International Investment Position (NIIP) of €0.1 billion.

As at the end of 2021, the Maltese economy recorded a NIIP of €7.7 billion, according to a National Statistics Office (NSO) report released on Wednesday.

The level of Malta’s total foreign assets abroad amounted to €269 billion as at the end of 2021 with portfolio investment accounting for 50 per cent while direct investment represented 26.6 per cent of total foreign assets.

The increase in Malta’s foreign assets was driven mainly by a €7.5 billion increase in portfolio investment and a €3.3 billion increase in other investment.

Meanwhile, at the end of December 2021, Malta’s foreign liabilities stood at €261.3 billion.

Direct investment amounted to €217.5 billion, up from €209.3 billion recorded in December 2020, and accounted for 83.2 per cent of total foreign liabilities. Moreover, other investment represented 14.6 per cent of total foreign liabilities and totalled €38.3 billion

Portfolio vs Direct Investment

The large difference between Malta’s foreign assets held as part of a portfolio (50 per cent) or directly (26.6 per cent) and Malta’s foreign liabilities held as part of a portfolio (1.8 per cent) or directly (83.2 per cent) may be better understood when looking at the meaning of these categories.

Portfolio investment signifies ownership of a financial asset without accompanying decision making powers. Such investment typically means holding shares or bonds in a company in a hands-off or passive manner.

On the other hand, direct investment typically involves a direct management role, such as when foreign companies open a subsidiary in another country – a common occurrence in Malta, but not so widely done by Maltese companies abroad.

Malta as a net creditor

Net creditor nations are those which have invested more of their own resources into other countries than other countries have invested in them.

The two creditor nations with the largest amount of investments abroad are Japan and Germany, which in 2019 registered net international investment positions of €3.03 trillion and and €2.5 trillion respectively.

China meanwhile expanded its position as a creditor nation from €1.4 trillion to €1.9 trillion from 2010 to 2019.

The world’s largest debtor nation is the USA, with a negative NIIP position of €10.2 trillion in 2019.

DIER cracks down on employment agencies bringing foreign workers to Malta

DIER has intensified its enforcement of employment agencies responsible for bringing foreign workers to Malta

Gozo issues call for roadmap to climate neutrality

The plan to achieve climate neutrality in Gozo by 2030 is ramping up

Two years since its birth, Moneybase features on Microsoft’s Customer Stories

Moneybase has now just been featured on Microsoft’s latest Customer Stories