It was an eventful month for international equities with a flash crash during the first few days of August that sent the main benchmark indices across the world into a tailspin reminiscent of the crash experienced in 1987.

The severe market reaction was attributed to a number of factors including a small monetary policy shift from the Bank of Japan as it raised its main interest rate from 0.1 per cent to 0.25 per cent (only the second hike in 17 years), escalating geopolitical tensions in the Middle East, underwhelming corporate earnings from a number of US technology companies and data indicating slowing US job growth.

The employment report, which showed a modest rise in unemployment and was weaker-than-expected, raised fears that the Federal Reserve, in its quest to reduce inflation, has slowed the US economy by too much through the high interest rate policy over recent months which could necessitate an emergency cut in interest rates even before the next scheduled meeting of the Federal Reserve on 18th September. The yield on the two-year Treasury, which closely tracks expectations for the Fed, briefly sank below 3.70 per cent on 5th August from 3.88 per cent the prior week and a high of five per cent in April.

Moreover, the news on Saturday 3rd August that Warren Buffett’s Berkshire Hathaway disclosed that it had reduced its ownership stake in Apple Inc by close to 50 per cent also added to the fears of a recession in the US economy.

Equity markets had already experienced significant moves during the second half of July but intensified on Monday 5th August. In fact, the Nasdaq 100 index had already dropped into correction territory (declines of more than 10 per cent since early July), wiping out more than USD2 trillion in value in just over three weeks as a result of the rotation out of the technology sector.

However, on Monday 5th August, Japan’s Nikkei 225 index plunged by 12.4 per cent for its worst day since the Black Monday crash in 1987 (and its second-worst daily decline in history) with the yen extending its rebound against the US Dollar to about 13 per cent from July’s low on expectations of further interest rate hikes by the country’s central bank thereby hitting the shares of Japanese exporters. For example, among some of the noteworthy household names of Japanese companies, it is worth highlighting that the share prices of Toyota Motor Corporation and Honda declined by 14 per cent and 18 per cent respectively on the day. Likewise, the share price of the electronics giant Sony shed eight per cent and Fast Retailing, the largest company on the Nikkei 225 index which owns the Uniqlo fashion chain, saw its share price drop by almost 10 per cent.

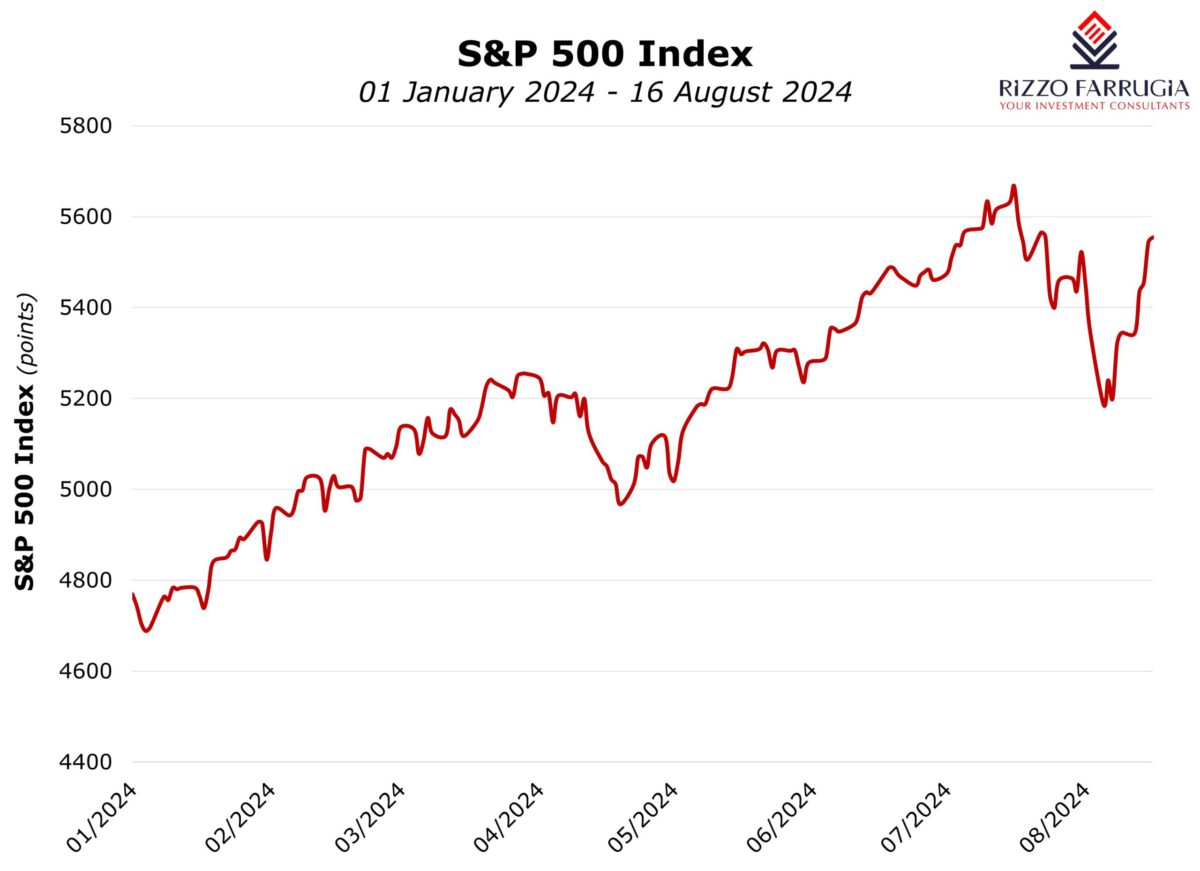

The sell-off in Japan extended into Europe as the markets opened on 5th August and also in the US later on the in day with the S&P 500 index, the Dow Jones Industrial Average and also the Nasdaq both opening sharply lower before partially recovering throughout the day to close around three per cent lower. The S&P 500 index suffered its biggest daily decline in about two years (and closing eight per cent below its record high in July) while the tech-heavy Nasdaq index experienced its worst start to a month since 2008.

Despite the magnitude of the sell-off and the headlines across the international media comparing the stockmarket sell-off to the crash in 1987, a number of renowned market commentators in the US immediately expressed their views that it was “not the time to panic” and instead, investors should “view this as more of an opportunity.” They were very right indeed as various benchmark indices and most share prices began to recover immediately and posted a spectacular recovery since then.

The recovery was brought about by the publication of new economic data last week confirming the resilience of the US economy (retail sales remaining surprisingly strong and inflation hitting a three-year low in July), improved consumption in China as well as a statement by the Bank of Japan in which it vowed to keep interest rates steady and not to proceed with any further rate hikes for the time being.

The fresh economic data in the US led to improved risk appetite on growing expectations that the world’s largest economy will avoid a recession after all, resulting in the best week for the year for US equity benchmark indices. The S&P 500 index advanced 3.9 per cent last week with the Dow Jones Industrial Average index climbing 2.9 per cent and the Nasdaq climbing by 5.3 per cent.

Since the low on Monday 5th August, the market cap of the constituents within the S&P 500 index increased by USD4 trillion with the index recovering all the losses sustained in the brief flash crash in early August and now just one per cent below the record intra-day high of 5,669.67 points reached on 16th July 2024.

Following the extraordinary events over the past few weeks that saw such intense volatility among a number of the large cap companies, there were countless articles published internationally on the overall behaviour of various types of investors and the near-term developments that could either lead to renewed nervousness across the financial markets or drive equity indices to reach new highs.

The Jackson Hole Economic Policy Symposium taking place at the end of this week will feature an intervention by the President of the Federal Reserve Jay Powell in which market participants would seek guidance on the thoughts of the central bank for the future direction of interest rates.

Market expectations are currently set for the Federal Reserve to start reducing interest rates by 25 basis points at the next policy meeting on 18 September as inflation continues to ease. Further reductions in interest rates are also anticipated in the remaining three Fed monetary policy meetings by the end of 2024.

More interestingly would be the reaction to the second-quarter results and upcoming guidance by Nvidia on 28th August. Nvidia dominates the market for the powerful processors needed to power large language models, with Microsoft, Meta Platforms and Amazon among its largest customers.

Although it is very hard to predict short-term movements in various asset classes, this flash-crash across the main equity markets should serve as another reminder to investors that volatility is a natural part of investing. Investors must be willing to accept short-term volatility as a key component to benefit from positive returns over the long term. In these circumstances, maintaining a diversified portfolio and keeping a long-term objective are the best tools to navigating uncertain times and achieve superior returns when compared to fixed-income instruments.

Read more of Mr Rizzo’s insights at Rizzo Farrugia (Stockbrokers).

The article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article.

PG’s revenue approaches €200 million

Record revenue for PG plc as supermarkets and franchise operations continue to grow amid competitive pressures

The power of compounding

An investment of $100 into Berkshire Hathaway in 1965 would have grown to a current value of over €4.3 million

How the CYBER+ALT Scheme fortified SMEs

Through the CYBER+ALT Grant Scheme, SMEs will be assisted through non-payable grants to part-finance their investment in cybersecurity measures