Greece attracted strong demand for its first sale of 30-year bonds since 2008, when the impacts of the US financial crisis instigated a sovereign debt crisis within the eurozone country.

Highlighting the country’s full return to international markets, its €2.5 billion bond issue attracted was oversubscribed tenfold, attracting €26 billion in investor orders.

The strong demand allowed underwriters to price the 30-year bonds at a yield of 1.956 per cent.

The issue on Wednesday follows a string of successful deals for Greece in recent months. A 10-year sale in January drew €29 billion in orders for €3.5 billion of debt. The Mediterranian country also raised a total of €12 billion from five new bond offerings in 2020.

Francesco Maria Di Bella, fixed-income strategist at UniCredit, told the Financial Times that “Greek bonds have generally recovered from the losses we have seen in the financial crisis and the eurozone sovereign crisis”.

The bond issue comes hot on the heels of an announcement by the European Central Bank (ECB) that it would be accelerating the pace of bond purchases to counter the recent rise in bond yields over concern that an excessive increase in household and business financing costs could undermine Europe’s recovery before it begins.

The ECB restarted its purchases of Greek debt in 2020 as part of its response to the COVID-19 pandemic, as it lifted a block on buying sovereign bonds rated below investment grade with the launch of its pandemic emergency purchase programme (PEPP).

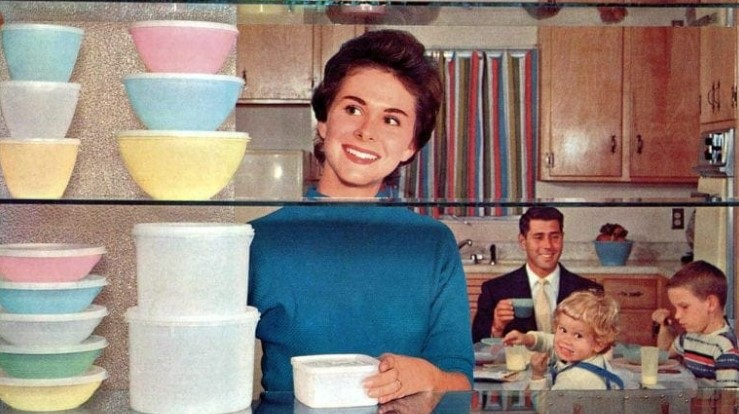

American icon Tupperware files for bankruptcy

The company has faced a decline in sales over recent years

Ryanair sets new record with 20.5 million passengers in August

Ryanair operated over 111,800 flights in August

High levels of harmful substances found in Shein clothing

Every single item tested was found to be tainted with dangerous chemicals