Last week, Hal Mann Vella Group p.l.c. published a Prospectus following regulatory approval for the admissibility to listing on the Regulated Main Market (Official List) of the Malta Stock Exchange of €23 million 5.35 per cent secured bonds redeemable between 2031 and 2034. The offer is mainly targeted to holders of the existing five per cent €30 million secured bonds maturing on 6th November 2024 (as at close of trading on 21st June 2024) who can exchange all or part of their investment with the new bonds. To participate, investors need to have the necessary knowledge and experience required for investing in callable bonds, and considered as eligible from a suitability perspective when they are provided an investment advice. The Group intends to refinance €7 million of the existing five per cent bonds through bank borrowings, and therefore the amount of issuance of the new bonds (€23 million) is less than the total outstanding amount of the five per cent bonds (€30 million).

Hal Mann Vella Group traces its origins in 1954 and, over the years, it grew extensively to become one of the leading local players in the manufacture and importation of natural and composite stones, pre-cast elements, and building materials. The Group boasts of a solid track record of service to renowned firms involved in some of the most prestigious and landmark real estate projects in Malta. These include high-rise commercial and residential buildings, mixed-use complexes, industrial premises, upscale hotels, and buildings of national importance such as Valletta City Gate, Ċittadella, and the Central Bank of Malta, amongst many others. Additionally, Hal Mann Vella Group has a flagship showroom and retail outlet situated next to its head office in Lija which serve as the primary contact point for the Group to showcase its extensive range of B2C products and services, including top-tier ceramic brands, sanitary ware, and kitchen tops.

The Group operates from two manufacturing plants located in Lija and Ħal Far, utilising state-of-the-art technology and advanced equipment, as well as a purposely built stores, logistics, and distribution hub. Hal Mann Vella Group is also currently extending its manufacturing capabilities in Ħal Far, increasing the footprint of Group’s facilities there to nearly 22,500 sqm from just over 14,300 sqm at present. The circa €7 million project, which is in its final stages of completion, is expected to lead to marked improvements in operational efficiencies and strengthen the core operations of the Group by introducing to the market a new range of products in the natural stone and terrazzo segments, niche screed and concrete supplies, landscaping products, as well as an innovative range of environmentally friendly solutions including reconstituted stone.

Apart from the manufacturing business, Hal Mann Vella Group is also actively engaged in the provision of general contracting services related to interior and exterior design, finishings, installation, laying, logistics, and maintenance. Furthermore, the Group is directly involved in the real estate sector through property development for resale and the ownership of a sizeable and diversified portfolio of investment property which was valued at just over €54 million as at the end of FY2023. This portfolio is fully leased out to independent third parties for the medium to long term and comprises hotels, restaurants, retail outlets, residential units, storage and logistics spaces, as well as offices including the E-Pantar building which is a major contributor to the Group’s property rental division.

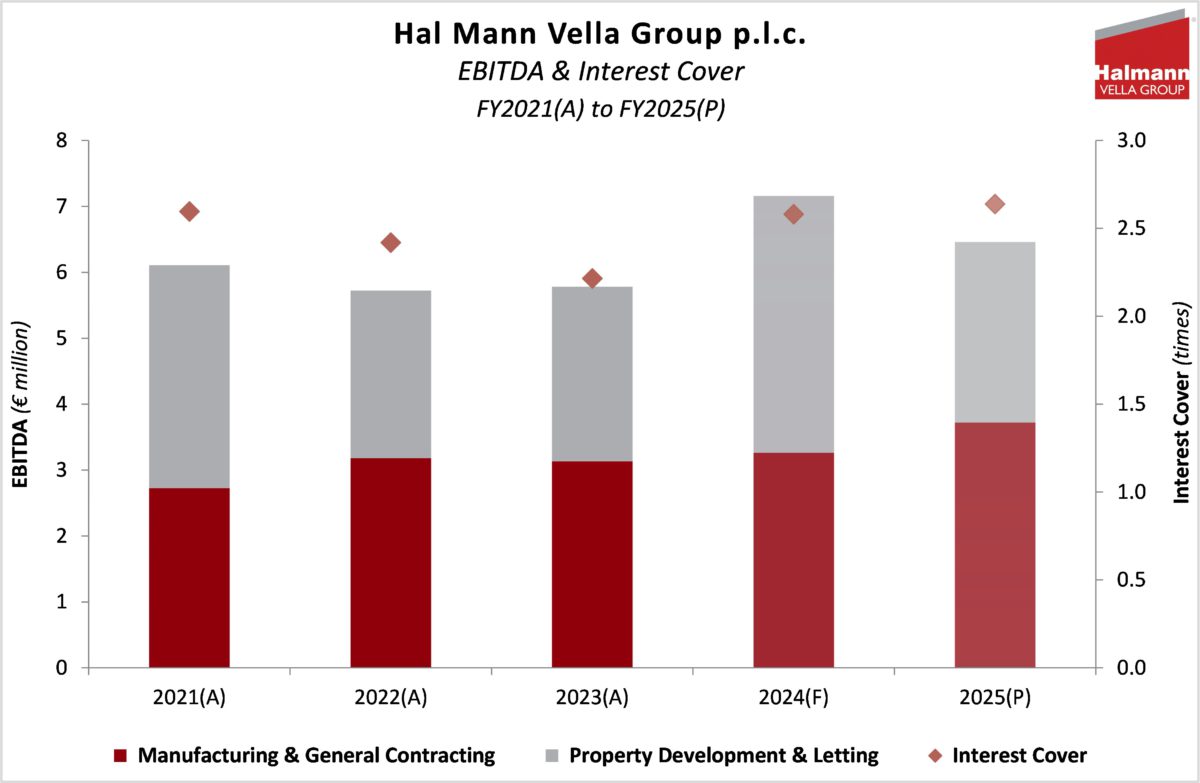

Hal Mann Vella Group had tapped the local corporate bond market for the first time in late 2014, and since then the Group pursued a successful strategy aimed at optimising its operations and asset base, improve its product and service offering, and strengthen its financial standing. In fact, over the nine-year period between 2014 and 2023, Hal Mann Vella Group saw its revenues rise by a compound annual growth rate (“CAGR”) of 6.71 per cent to €25.08 million in FY2023 (FY2014: €13.98 million) whilst EBITDA surged by a CAGR of 31.35 per cent to €5.78 million in FY2023 from a mere €0.50 million in FY2014. The latter also resulted in an over six-fold increase in the EBITDA margin to 23.06 per cent in FY2023 compared to just 3.56 per cent in FY2014. Moreover, during the same period, the Group’s asset base expanded by a CAGR of almost six per cent to €130.88 million as at the end of FY2023 mostly due to the redevelopment of a number of underutilised or vacant sites into investment properties that today form an integral part of the Group’s business model.

Meanwhile, as Hal Mann Vella Group underwent this transformation, it consistently maintained a prudent and disciplined approach to capital management. Despite the increase in total debt across the years to almost €56 million as at the end of FY2023 (when including lease liabilities amounting to €8.22 million) from €37.66 million as at 31st December 2014, the net gearing ratio has always been maintained at an appropriate level close to 50 per cent. This ratio reflects the expansion in the Group’s equity base which increased to €51.59 million as at 31st December 2023 from €30.14 million as at the end of FY2014. Similarly, the debt-to-assets ratio followed a downward trend during this period and stood at 0.43 times as at the end of FY2023 compared to 0.48 times as at 31st December 2014. This essentially means that almost 60 per cent of the Group’s assets are not funded by debt which is a very important metric for investors to consider given the capital-intensive nature of the Group’s business.

Looking ahead, the forward financial information provided in the Bond Prospectus show that Hal Mann Vella Group is poised for additional growth. In fact, revenues are estimated to increase by 12.55 per cent to €28.23 million in FY2024, and grow by a further 8.77 per cent to €30.71 million in FY2025, mostly driven by the Group’s core manufacturing operations on the back of the strong pipeline of business as well as the impact of the new facilities in Ħal Far. Furthermore, although EBITDA is anticipated to contract to €6.46 million in FY2025 from the estimated figure of €7.16 million in FY2024, the projected year-on-year decline is due to the non-recurrence of the expected gains to be registered in the current financial year from the sale of the Mavina Holiday Complex and a villa in Madliena. Nonetheless, the interest cover is still anticipated to trend higher to 2.64 times in FY2025, reflecting reflects the Group’s comfortable position when it comes to servicing its debt obligations. Equally important are the Group’s targets to further reduce its financial leverage over the coming months and end the 2025 financial year with a net gearing level of close to the 45 per cent level and a debt-to-assets ratio of 0.42 times.

During roadshow presentations to institutional investors and investment firms, Hal Mann Vella Group clearly explained its strategic decision to refinance part of its existing five per cent secured bonds maturing in 2024 with the issuance of the new 5.35 per cent secured bonds maturing between 2031 and 2034. Despite having access to potentially cheaper sources of finance, the Group recognises the importance and benefits of maintaining its presence on the local capital market through this new bond issue. In this respect, Hal Mann Vella Group should not only be seen by investors as another household name whose bonds are listed on the Malta Stock Exchange, but also as a point of reference for other private companies looking to raise capital and/or seek to diversify their funding mix via the local corporate bond market.

Disclaimer:

This article was written by Josef Cutajar, Financial Analyst at M.Z. Investment Services Limited (“MZI”). The author has obtained the information contained in this article from sources believed to be reliable and has not verified independently the information contained herein. The contents of the article are the author’s views and may not reflect the other opinions in the organisation. The article is being published solely for information purposes and should not be construed as investment, legal, or tax advice, or as a recommendation to buy, sell, or hold any security, investment strategy or market sector. The financial instrument referred to in this article may not be suitable or appropriate for every investor. Prospective investors are urged to consult their Investment Adviser prior to making an investment. Past performance is no guarantee of future results, and the value of investments may go down as well as up. MZI accepts no responsibility or liability whatsoever for any expense, loss or damages arising out of, or in any way connected with, the use of all or any part of this article. No part of this article may be shared, reproduced, or distributed at any time without the prior consent of MZI. MZI is acting as Sponsor to Hal Mann Vella Group p.l.c. and an authorised financial intermediary to the Hal Mann Vella Group p.l.c. bond issue.

M.Z. Investment Services Limited of 63, MZ House, St Rita Street, Rabat RBT 1523, Malta, is regulated by the Malta Financial Services Authority and licensed to conduct investment services business in terms of the Investment Services Act (Cap. 370 of the Laws of Malta). MZI is a member of the Malta Stock Exchange and is an enrolled Tied Insurance Intermediary under the Insurance Distribution Act (Cap. 487 of the Laws of Malta) for MAPFRE MSV Life p.l.c. Telephone: +356 21453739; Email: info@mzinvestments.com; Website: www.mzinvestments.com.

ECB lowers key interest rates by 25 basis points in response to inflation outlook

While inflation remains high, the ECB projects it will ease in the second half of next year

PG’s revenue approaches €200 million

Record revenue for PG plc as supermarkets and franchise operations continue to grow amid competitive pressures

HSBC Malta share price drops sharply following strategic review announcement

Market analysts suggest that the uncertainty surrounding the review, with speculation of an impending sale, has fuelled investor concerns