*Updated to reflect a report by WhosWho.mt that APS Bank plc has been identified as the local financial institution in talks to acquire HSBC Bank Malta

HSBC Bank Malta has experienced a significant drop in its share price, falling from €1.65 to €1.35 overnight, and further down to €1.30 following the announcement of a strategic review. This 21 per cent decline comes after the parent company, HSBC Holdings plc, informed the public on Wednesday that it would be reviewing its indirect shareholding in the Maltese subsidiary, sparking immediate concerns about the bank’s future in the local market.

The announcement, made in accordance with the bank’s market obligations, has prompted speculation that HSBC may be preparing to exit the Maltese market altogether. This would mark a major shift for the bank, which has been a key player in Malta’s economy for decades. The news has undoubtedly unsettled investors, reflected in the swift sell-off that caused the share price to drop so steeply.

Market reactions and investor sentiment

Sources within the industry have indicated that a potential sale of HSBC Malta to a local financial institution is in the advanced stages, though no deal has yet been confirmed, as reported by WhosWho.mt. It later reported, quoting senior officials privy to negotiations, that APS Bank plc is the local institution in advanced talks to acquire HSBC Malta.

Market analysts suggest that the uncertainty surrounding the review, coupled with the speculation of an impending sale, has fuelled investor concerns. While HSBC’s local operations have seen a reduced physical footprint in recent years, including the closure of several branches, the bank remains the second-largest in Malta by a considerable margin.

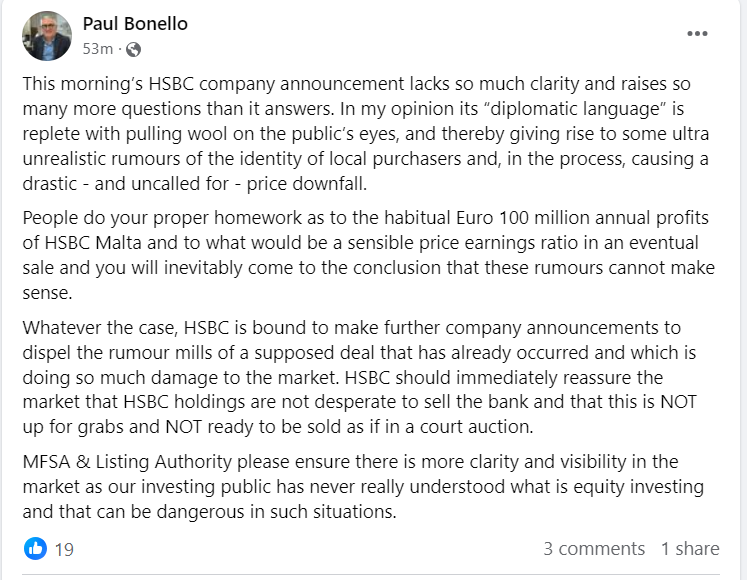

Seasoned stockbroker Paul Bonello, writing on social media, remarked that HSBC’s announcement of a strategic review this morning “lacks so much clarity and raises so many more questions than it answers”.

Sharing his personal opinion, he criticised the bank’s “diplomatic language” is “replete with pulling wool on the public’s eyes”.

He believes the language used has given rise to “some ultra unrealistic rumours of the identity of local purchasers, and, in the process, causing a drastic – and uncalled for – price downfall”.

Mr Bonello dismissed media reports of a local financial institution possibly acquiring HSBC Malta, pointing to “the habitual €100 million annual profits of HSBC Malta and to what would be a sensible price earnings ratio, and you will inevitably come to the conclusion that these rumours cannot make sense.”

“HSBC should immediately reassure the market that HSBC holdings are not desperate to sell the bank and that this is not up for grabs and not ready to be sold as if in a court auction.

“MFSA please ensure there is more clarity and visibility in the market as our investing public has never really understood what is equity investing and that can be dangerous in such situations.”

Impact on the Maltese economy

The drop in share price could have wider implications for Malta’s financial sector. HSBC Malta is deeply embedded in the local economy, holding over €6 billion in customer deposits and issuing €3.1 billion in loans, according to its most recent financial report. Its exit, should the review lead to that outcome, could create both challenges and opportunities for other local financial institutions.

HSBC’s position on the matter

In its announcement, HSBC emphasised that it remains committed to serving its customers and that the strategic review is simply part of its broader evaluation of options. In comments made to WhosWho.mt, an HSBC representative stated that “no decisions have been made yet” and reiterated that the bank’s operations continue as usual.

While the review continues, all eyes are on the bank’s future in Malta, and investors will likely remain cautious until a clearer picture emerges regarding HSBC’s long-term plans.

Finance Minister confirms continuity of food and energy subsidies

Spending on food and energy subsidies as a percentage of the GDP will be at 0.7% in 2025

MHRA congratulates Glenn Micallef on EU role, highlights positive impact on Malta’s tourism and cultural sectors

The lobby group emphasised that Malta’s cultural assets and sports scene are key factors in attracting visitors and fostering economic ...

SME Chamber and Malta Developers Association slam controversial Identità lease attestation form

Identità's new procedure concerning lease attestation forms was not welcomed by these local stakeholders