Last week, International Hotel Investments plc published a Prospectus following regulatory approval for the admissibility to listing on the Official List of the Malta Stock Exchange of €60 million six per cent unsecured bonds maturing in 2033. Most of the proceeds are earmarked towards the redemption of the existing 5.8 per cent and six per cent unsecured bonds maturing in mid-November 2023 and mid-May 2024 respectively. The remaining funds are for general corporate funding purposes.

The timing of this new bond issue coincides with the start of a new journey for IHI as over the coming three years, the Group will be inaugurating seven Corinthia hotels located in Europe (Brussels, Bucharest, and Rome in 2024), the US (New York in 2024), the Middle East (Doha in 2025 and Diriyah in 2026), and South Asia (Maldives in 2026). Of these, six are owned by well-established third-party investors including Reuben Brothers as well as United Development Company whose main shareholder is the Pension Fund of Qatar. The remaining property is the former Grand Hotel Astoria in Brussels which is 50 per cent owned by the Group. Acquired in 2016, the historic property is currently undergoing extensive redevelopment at an estimated cost of €120 million. Upon completion in June 2024, the 126-room Corinthia Hotel Brussels will offer unrivalled amenities including a fully restored grand ballroom, an 850 sqm spa, various dining venues, luxurious boutique meeting facilities, as well as high-end retail outlets.

Furthermore, IHI has applied to the Planning Authority for the proposed redevelopment of a large tract of land measuring over 83,000 sqm situated in an area known as ‘Ħal-Ferħ’ in proximity to the Radisson Blu Resort & Spa, Golden Sands, Malta. The Group intends to construct a low-rise, mixed-use complex – Corinthia Oasis – comprising a 162-key luxury hotel and 25 detached and serviced villas supported by a top-tier wellness centre and spa, food and beverage outlets, as well as a host of ancillary resort amenities.

In aggregate, IHI’s total room inventory is expected to grow by circa 15 per cent by 2026 to almost 5,800 keys from the current stock of around 5,050 rooms. Furthermore, it is pertinent to point out that the proportion of the Group’s room inventory not owned by IHI is projected to increase to just under 32 per cent from the current level of nearly 28 per cent. This is due to the considerable emphasis being placed by the Group to promote its hotel management and development services to third-party investors as part of its drive to continue expanding the Corinthia brand internationally without the need of considerable capital outlay. In this respect, it is meaningful to note the Memorandum of Understanding that IHI signed earlier this year with Jeddah Central Development Company, owned by the sovereign wealth fund of the Kingdom of Saudi Arabia. This agreement provides a basis for the Group to develop and operate real estate within the Marina District which is part of the pioneering Jeddah Central €19 billion waterfront project spanning along a 9.5-km shoreline on the Red Sea forming part of the country’s grand ‘Saudi Vision 2030’.

Another important pillar of IHI’s strategy provides for the disposal of assets that either do not offer any meaningful additional returns in terms of potential capital appreciation or no longer fit the Group’s profile. In this context, it is worth recalling the missed sale of Corinthia Hotel Prague for €158 million in late 2019/early 2020 (compared to the book value of €92.6 million at the time), which unfortunately had to be aborted in view of the global abrupt outbreak of the COVID-19 pandemic. The COVID-19 pandemic not only deprived IHI of realising huge profits from the sale of Corintha Hotel Prague, but also adversely impacted the Group’s operational performance.

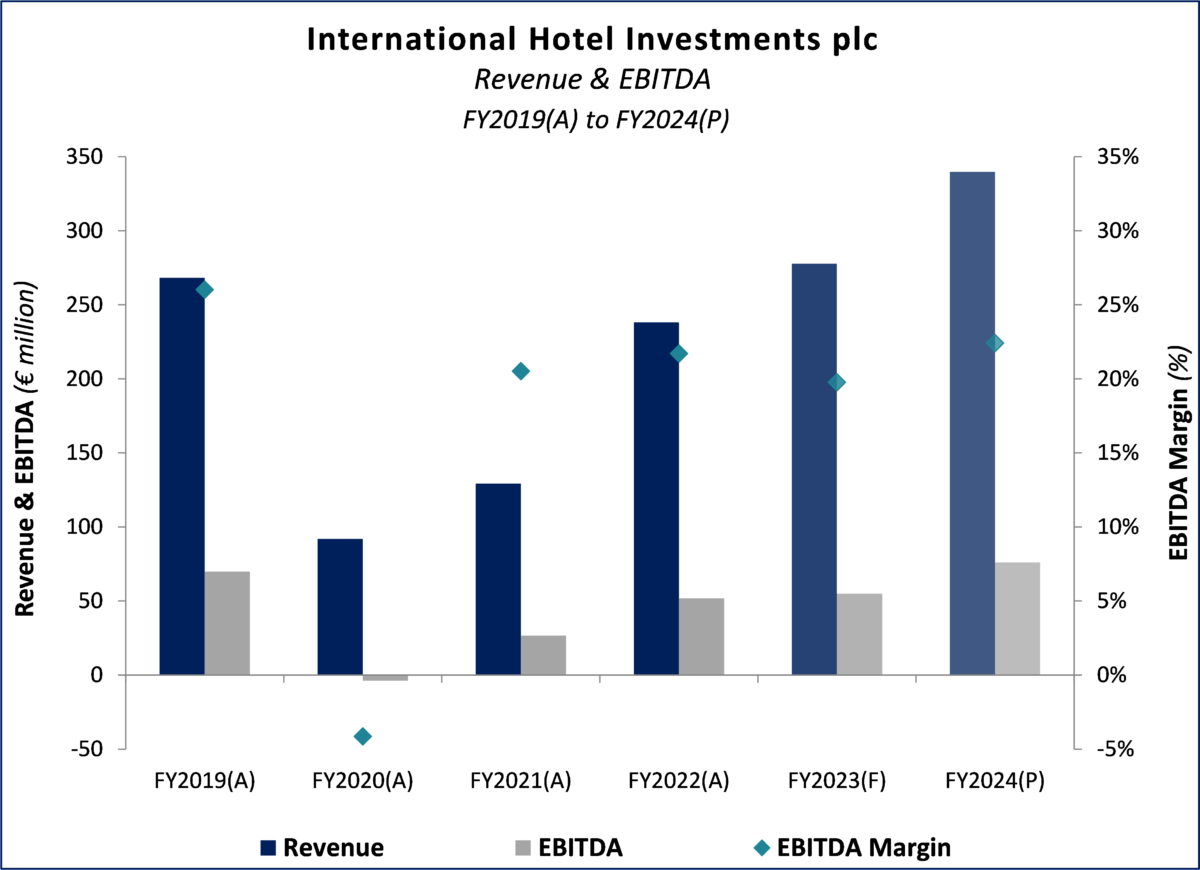

In fact, IHI generated an aggregate EBITDA of €74.43 million between FY2020 and FY2022 which was only marginally higher than the record EBITDA of €69.79 million registered in FY2019 alone. In the meantime, other major global events took place in the past two years which also negatively impacted the Group, including the upsurge in inflation and salaries, the increase in interest rates, and the war in Ukraine.

The outcome of these dynamics is clearly visible in IHI’s updated financial forecasts for FY2023 and the new projections for FY2024. Although the Group is anticipating record revenues of €277.76 million for this year compared to €268.29 million in FY2019, the target EBITDA of €54.88 million for FY2023 is lower than the level of €69.79 million registered in FY2019. Accordingly, the EBITDA margin is estimated to contract to 19.76 per cent in FY2023 before improving to 22.40 per cent in FY2024 reflecting the initial contributions from the new landmark properties located in Brussels, Bucharest, Rome, and New York.

Another important consideration is related to the Group’s finance costs which are now having a bigger impact on IHI’s bottom-line. This reflects the extent of the aggressive monetary policy tightening adopted by the European Central Bank since July 2022 as it lifted its key benchmark interest rate to an all-time high of four per cent from a record low of minus 0.5 per cent. In addition, the Group increased its indebtedness in recent years ahead of its upcoming major international expansion. Coupled with the adverse movement in interest rates, the interest cover is expected to decline to 1.44 times in FY2023 before improving to 1.48 times in FY2024 reflecting the projected further uplift in EBITDA to a new record of €76.13 million on revenues of €339.87 million. Likewise, the net debt-to-EBITDA multiple is projected to ease to 10.78 times in FY2024 from the estimated level of 12.49 times in the current financial year.

The new bond issue comes at a momentous time for IHI as the company approaches its most significant and exciting growth phase in its history. This once again demonstrates the remarkable resilience and tenacity of the Group after successfully navigating the challenging period of the COVID-19 pandemic and sustaining its operations in Libya throughout the country’s decade-long internal political instability. Indeed, the potential resolution of the conflicts in Libya and Russia could serve as two additional major drivers for IHI to further enhance its profile and pursue its ambitions. Equally important are the opportunities for the Group to extract additional value from its rich asset base, realise additional economies of scale and synergies via a more extensive global outreach (including through the new ‘Verdi Hotels’ brand targeting the upper 4-star and lower 5-star segments), as well as leverage its strong connections with prominent investment firms and sovereign wealth funds.

Disclaimer:

This article was written by Josef Cutajar, Financial Analyst at M.Z. Investment Services Limited (“MZI”). The author has obtained the information contained in this article from sources believed to be reliable and has not verified independently the information contained herein. The contents of the article are the author’s views and may not reflect the other opinions in the organisation. The article is being published solely for information purposes and should not be construed as investment, legal, or tax advice, or as a recommendation to buy, sell, or hold any security, investment strategy or market sector. The financial instrument referred to in this article may not be suitable or appropriate for every investor. Prospective investors are urged to consult their Investment Advisor prior to making an investment. Past performance is no guarantee of future results, and the value of investments may go down as well as up. MZI accepts no responsibility or liability whatsoever for any expense, loss or damages arising out of, or in any way connected with, the use of all or any part of this article. No part of this article may be shared, reproduced, or distributed at any time without the prior consent of MZI. MZI is acting as Sponsor to International Hotel Investments plc and an authorised financial intermediary to the International Hotel Investments plc bond issue.

MZI is a member of the Malta Stock Exchange and is licensed by the Malta Financial Services Authority to conduct investment services business under the Investment Services Act (Cap. 370) (License N° IS23936). M.Z. Investment Services Limited, 63 ‘MZ House’, St Rita Street, Rabat RBT 1523. Telephone: +356 21453739; Email: info@mzinvestments.com; Website: www.mzinvestments.com.

ECB lowers key interest rates by 25 basis points in response to inflation outlook

While inflation remains high, the ECB projects it will ease in the second half of next year

HSBC Malta share price drops sharply following strategic review announcement

Market analysts suggest that the uncertainty surrounding the review, with speculation of an impending sale, has fuelled investor concerns

‘This is true one-touch implementation designed with SMEs in mind’ – Roderick Farrugia, CIO, Melita Limited

A walk through the primary cybersecurity threats facing today’s SME’s and Melita’s practical solutions to combat them