China may need to get used to a rate of economic growth far lower than that it has enjoyed for the last two decades, as problems left untreated for years come back to bite.

On Thursday, property giant Evergrande, one of China’s largest real estate developers involved in over 1,300 projects in more than 280 cities, applied for bankruptcy protection in the United States, allowing safeguard its assets in the country while giving it time to strike deals with creditors.

It had already defaulted in 2021, and last month revealed that it had lost a combined $80 billion over the last two years.

It is not alone – another major developer, Country Garden, recently announced that it lost around $7.6 billion in the first half of 2023.

Unlike Vegas, what happens in real estate rarely stays in the sector, with a stressed property market carrying potentially huge implications for the world’s second largest economy, including its banking sector.

These problems are compounded by a slowdown in both imports and exports, which in July were down 12.4 per cent and 14.5 per cent year-on-year, respectively – despite the final removal of all COVID-19 restrictions and the resolution of a shipping crisis in the interim.

China’s ruling party set growth projections of five per cent for 2023 – notably lower than the average of nine per cent growth it has enjoyed for the better part of two decades. Even so, many analysts doubt whether the country can achieve even these tamped down expectations.

In stark contrast to the actions taken in most developed economies, China’s central bank has lowered interest rates twice in the last three month, in a bid to boost the economy.

The country’s current issues can be attributed to a number of factors, ranging from simple mismanagement in its property sector to more structural forces like a declining birth rate.

Economies that base their growth on manufacturing also tend to struggle with keeping up long-term momentum, and in China’s case this has been exacerbated by worsening trade relations with the US and the EU, which have resulted in targeted sanctions from all sides.

Meanwhile, China’s foreign economic policy, especially its Belt and Road Initiative, which provides finance for infrastructure projects in other countries, is losing its shine. Italy, the sole major developed economy that was set to participate in the initiative, pulled out a few weeks ago, describing it as “atrocious”.

With the pressure piling on and a population now used to years of relative largesse, China’s leaders have a lot to think about.

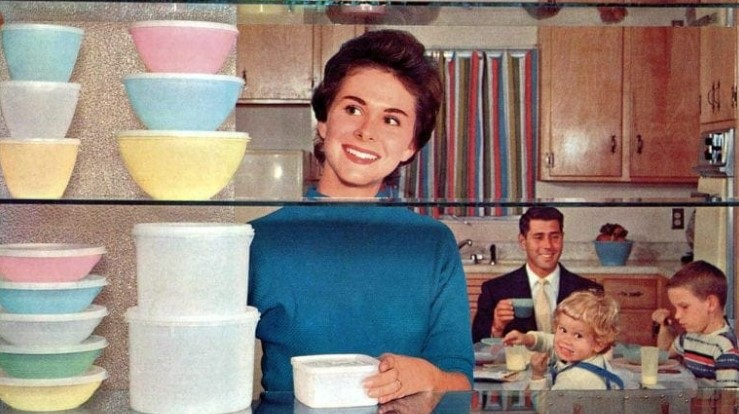

American icon Tupperware files for bankruptcy

The company has faced a decline in sales over recent years

Ryanair sets new record with 20.5 million passengers in August

Ryanair operated over 111,800 flights in August

High levels of harmful substances found in Shein clothing

Every single item tested was found to be tainted with dangerous chemicals