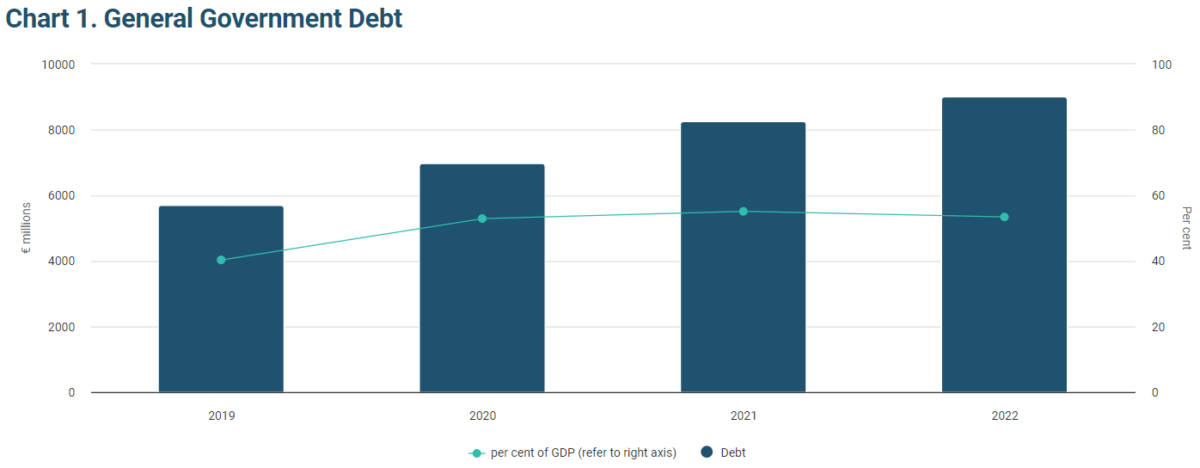

More than a third of all debt accumulated by the Government came about during the three years affected by the COVID-19 pandemic, from 2020 to 2022.

Malta’s General Government debt grew by 8.9 per cent to €9 billion in 2022. While significant, it’s notably less compared to the 18.4 per cent growth in debt witnessed in 2021.

Data made available by the National Statistics Office shows that Malta’s sovereign debt stood at 53.4 per cent of GDP at the end of 2022.

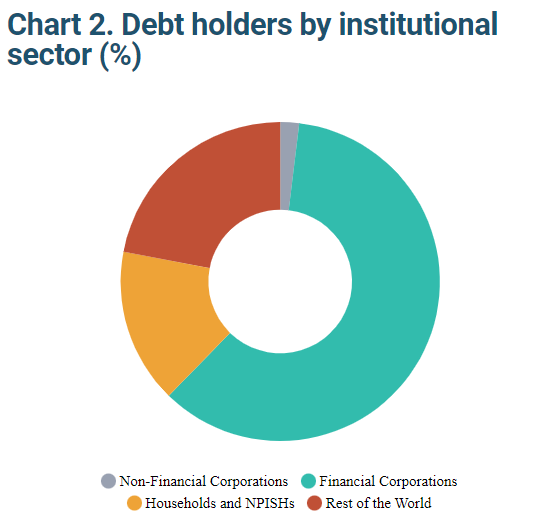

Financial corporations continued to hold the largest share of national debt, which saw its share grow to 60.4 per cent from 58.7 per cent.

This was followed by the share of debt owned by the rest of world, which fell to 22 per cent from 23.8 per cent. Meanwhile the share of debt owned by households and non-profit institutions (NPISH) stood at 15.7 per cent.

In 2021 the amount of debt owned by foreign interests surpassed the sum owned by local households for the first time. While this appears to slowly be reversing, there is still a significant gap.

Between 2019 and 2022, the rest of the world sector experienced the highest growth in the holding of Government debt, which increased by 6.9 percentage points.

Between 2020 and 2022, the three years affected by the COVID-19 pandemic, total Government debt grew by €3.28 billion. Financial corporations were responsible for €2 billion of the pandemic era debt, followed by €1.1 billion from the rest of the world.

The amount of new debt owned by non-financial corporations, households and non-profit institutions only increased by €138 million in total.

Debt securities, which include Malta Government Stocks and Treasury Bills, are by and large the preferred debt instrument, with 85.1 per cent, of the total debt in 2022. Other debt instruments are loans and currency, with 9.6 per cent and 5.3 per cent, respectively.

The largest increase was recorded under debt securities (€820.9 million), and it mainly relates to the Government’s financing of the budget expenditures, which includes the financing of the energy support measures.

Almost all the debt owed by the General Government Sector is in national currency.

The apparent cost of debt, which is the interest rate applicable to the whole nominal debt, was 1.9 per cent in 2022, compared to 3.3 per cent in 2019.

This measure of debt cost reflects the interest rates in effect at the time of issuance, and because debt is predominantly long-term, the indicator is not particularly sensitive to the current prevailing interest rate scenario.

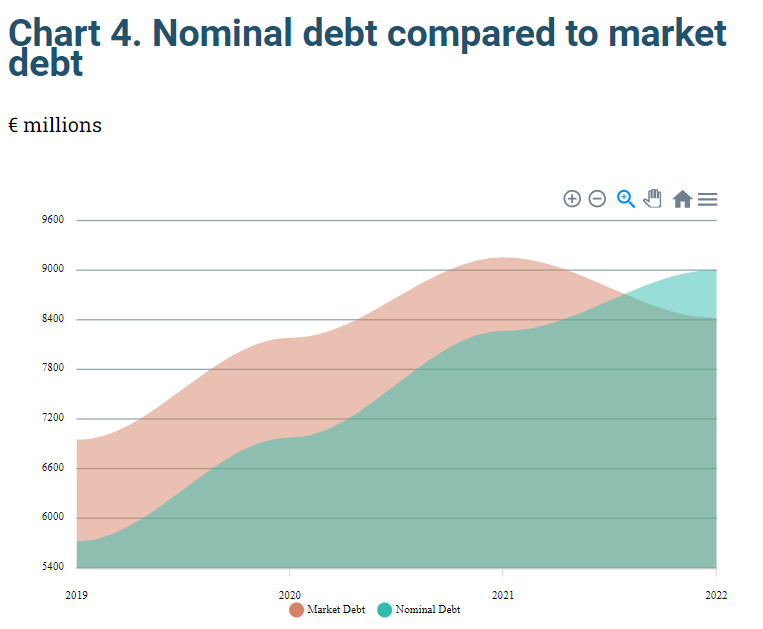

For 2022, the market value of the total General Government debt is estimated at €8.42 billion, compared to the nominal value of €9 billion.

While nominal debt increased by €739.5 million, market debt decreased by €734.2 million as a result of high inflation and subsequent interest rate increases.

For the year under review, the time structure of the debt by initial maturity shows that €2.82 billion, or 31.4 per cent, was issued with a maturity of 15 to 30 years.

This was followed by debt issued for one to five years (16.2 per cent), five to seven years (13.9 per cent), seven to 10 years (13.6 per cent), 10 to 15 years (10.3 per cent), less than one year (10.3 per cent) and more than 30 years (4.3 per cent).

The average remaining maturity of total debt for 2022 was eight years four months, seven months shorter than in 2021 and two months shorter than in 2019.

In 2022, the biggest share of debt by remaining maturity was in the one to five-year category with €2.27 billion, followed by the seven to 10-year (€1.85 billion) and the less than one-year (€1.35 billion) categories.

Government guarantees on borrowing amounted to €1.16 billion in 2022, or 6.9 per cent of GDP, a decrease of €50.1 million over 2021.

The majority of Government guarantees are issued towards the non-financial corporations sector, which accounts for 61.8 per cent of the total guarantees. The financial corporations, rest of the world and NPISH sectors benefitted from 34.4, 3.0 and 0.7 per cent of Government guarantees, respectively.

The Government guarantees are contingent liabilities, contingent on the actual call of the guarantee, and therefore these do not form part of General Government debt.

ECB lowers key interest rates by 25 basis points in response to inflation outlook

While inflation remains high, the ECB projects it will ease in the second half of next year

HSBC Malta share price drops sharply following strategic review announcement

Market analysts suggest that the uncertainty surrounding the review, with speculation of an impending sale, has fuelled investor concerns

‘This is true one-touch implementation designed with SMEs in mind’ – Roderick Farrugia, CIO, Melita Limited

A walk through the primary cybersecurity threats facing today’s SME’s and Melita’s practical solutions to combat them