The National Statistics Office has released its economic data for 2020, revealing a contraction in GDP of 5.7 per cent, far smaller than the 8.2 per cent estimated by the Central Bank of Malta in February.

The contraction was expected after a year of severe disruption caused by the COVID-19 pandemic that brought one of Malta’s most important economic sectors, tourism, to an almost complete standstill, with spillover effects felt in many other sectors like retail and events.

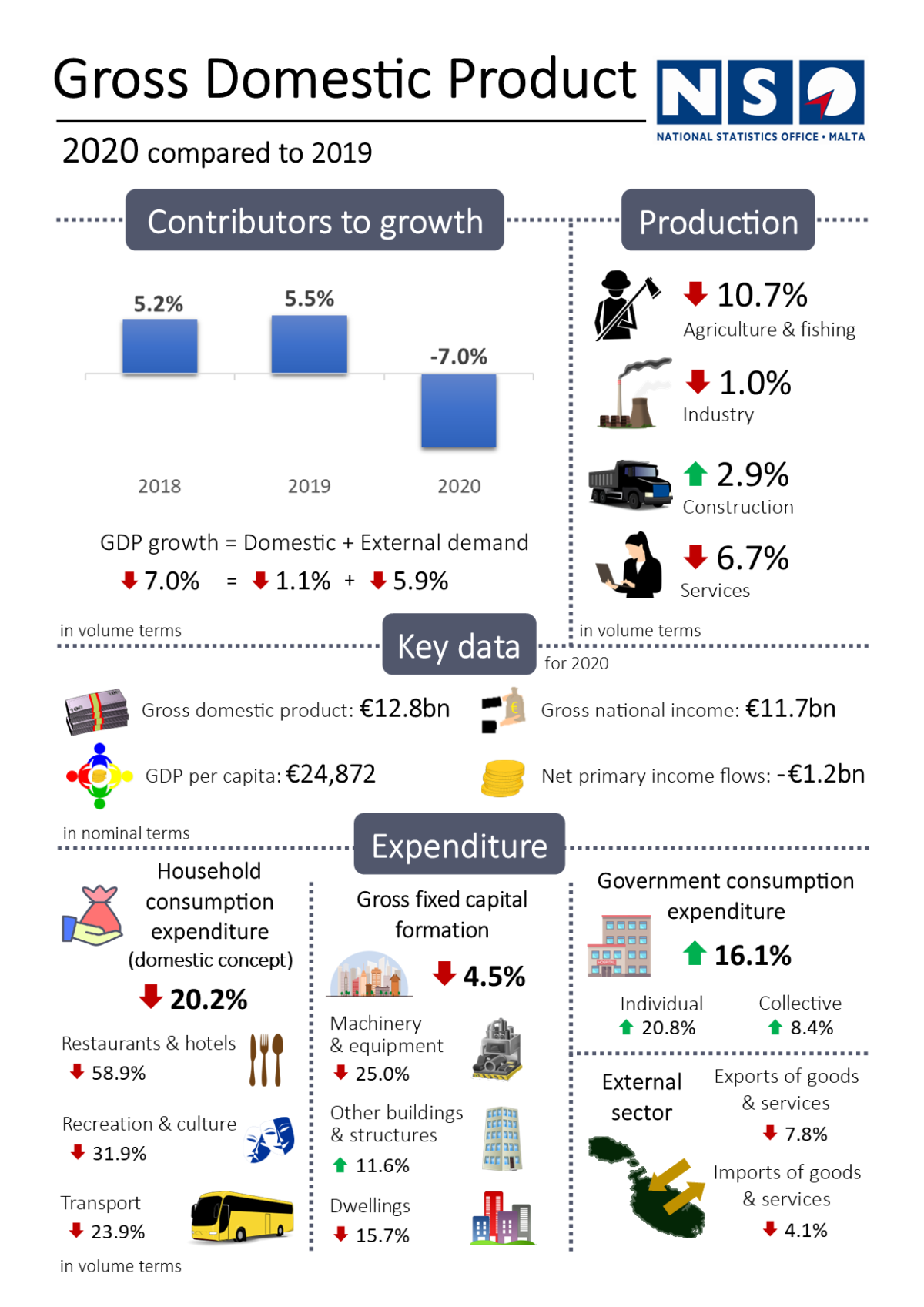

The NSO’s statement, released on Monday, said provisional figures showed GDP amounted to €12,823.8 million, a decrease of €768.4 million, or 5.7 per cent, when compared to 2019. In volume terms, GDP fell by 7.0 per cent.

The production approach

During 2020, Gross Value Added (GVA) fell by 4.3 per cent in nominal terms and 5.8 per cent in volume terms, when compared to 2019.

This contraction in GVA was mainly due to a drop of 6.7 per cent in Services (NACE sections G to U) in volume terms. Industry and Agriculture and fishing declined by one per cent and 10.7 per cent, respectively.

On the other hand, Construction registered an increase of 2.9 per cent.

The drop in Services was mainly driven by decreased activity in Accommodation and food service activities (-64.7 per cent), Transportation and storage activities (-43.1 per cent), Wholesale and retail trade activities (-9.9 per cent), and Administrative and support services activities (-10.7 per cent).

Services activities which contributed positively to GVA included Information and communication activities (13.6 per cent), Arts, entertainment, and recreation activities (10.0 per cent), Financial and insurance activities (3.9 per cent), and Public administration (5.5 per cent).

Net taxes on products contributed negatively towards GDP growth with a decline of 17.1 per cent in volume terms.

The expenditure approach

The expenditure approach is another method used to calculate GDP and is derived by adding Final consumption expenditure of Households, General government and Non-profit institutions serving households, Gross capital formation and Net exports.

During 2020, Total final consumption expenditure witnessed an increase of 0.4 per cent in nominal terms and a drop of 1.1 per cent in volume terms. The latter was the result of a decrease in Household expenditure of 7.9 per cent, which was partly offset by an increase in the expenditure of Non-profit institutions serving households of 3.5 per cent and a rise in General government expenditure of 16.1 per cent.

Gross fixed capital formation (GFCF) declined by 3.6 per cent in nominal terms and 4.5 per cent in volume terms. The drop in GFCF was mainly triggered by a decrease of 15.7 per cent in Dwellings and a drop of 25.0 per cent in Machinery and equipment in volume terms.

Exports of goods and services fell by 7.3 per cent in nominal terms and 7.8 per cent in volume terms. Moreover, Imports of goods and services declined by 3.7 per cent in nominal terms and 4.1 per cent in volume terms.

The income approach

The income approach to measuring economic activity shows how GDP is distributed among compensation of employees, operating surplus of enterprises and taxes on production and imports net of subsidies.

Compared to 2019, the €768.4 million decrease in GDP in nominal terms was primarily a result of a €137.8 million increase in compensation of employees, a €216.8 million decline in gross operating surplus and mixed income, and a drop of €689.4 million in net taxation on production and imports.

Gross National Income (GNI)

The GNI differs from the GDP measure in terms of net compensation receipts, net property income receivable and net taxes receivable on production and imports from abroad.

Considering the effects of income and taxation paid and received by residents to and from the rest of the world, GNI at market prices for 2020 was estimated at €11,669.9 million.

ECB lowers key interest rates by 25 basis points in response to inflation outlook

While inflation remains high, the ECB projects it will ease in the second half of next year

HSBC Malta share price drops sharply following strategic review announcement

Market analysts suggest that the uncertainty surrounding the review, with speculation of an impending sale, has fuelled investor concerns

‘This is true one-touch implementation designed with SMEs in mind’ – Roderick Farrugia, CIO, Melita Limited

A walk through the primary cybersecurity threats facing today’s SME’s and Melita’s practical solutions to combat them