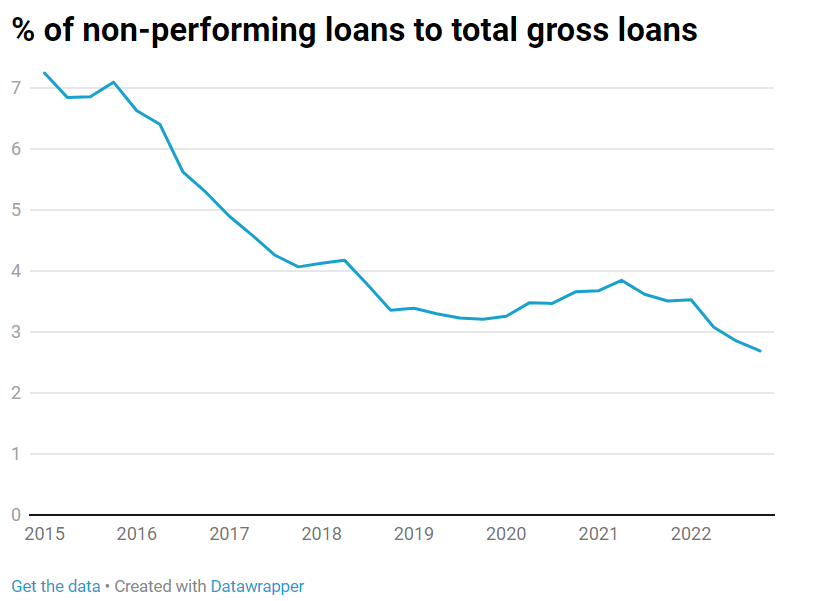

The share of non-performing loans extended by Maltese banks compared to the total gross loan value has dropped to its lowest level in years.

Just 2.69 per cent of all loans were non-performing by the end of the fourth quarter of 2022, as compared to over seven per cent in the same quarter of 2015.

The data, released by the Central Bank of Malta in its latest Financial Soundness Indicators, shows that the Maltese banking sector is in a healthy position, with plenty of liquidity and a strong return on equity.

The sector’s exposure to construction also seems to have been significantly reduced. In 2015, over six per cent of all loans were extended to this industry, but by the end of 2022, this had fallen to 2.2 per cent.

On the other hand, exposure to financial and insurance activities has increased more than threefold, from just over eight per cent of all loans in 2015 to just under 30 per cent in Q4 2022.

Households and individuals remain the main sector served by banks, with over 40 per cent of all loans going to this sector.

This data refers to Malta’s core banks, which are Bank of Valletta, APS Bank, HSBC, Lombard Bank, BNF Bank, and MeDirect Bank.

ECB lowers key interest rates by 25 basis points in response to inflation outlook

While inflation remains high, the ECB projects it will ease in the second half of next year

HSBC Malta share price drops sharply following strategic review announcement

Market analysts suggest that the uncertainty surrounding the review, with speculation of an impending sale, has fuelled investor concerns

‘This is true one-touch implementation designed with SMEs in mind’ – Roderick Farrugia, CIO, Melita Limited

A walk through the primary cybersecurity threats facing today’s SME’s and Melita’s practical solutions to combat them