The German industrial conglomerate Siemens AG has become one of the first companies in the country to issue a digital bond, in accordance with Germany’s Electronic Securities Act

The €60 million bond issue has a maturity of one year and is underpinned by a public blockchain.

Crypto media reports indicate that the blockchain protocol used is Polygon, which aims to create a multi-chain blockchain ecosystem compatible with Ethereum (the second-largest blockchain network after Bitcoin).

In a press statement released on Monday, Siemens, Europe’s largest industrial manufacturer, said that issuing the bond on a blockchain “offers a number of benefits compared to previous processes”.

“For instance, it makes paper-based global certificates and central clearing unnecessary.

“What’s more, the bond can be sold directly to investors without needing a bank to function as an intermediary,” it said.

Ralf P. Thomas, Siemens’ chief financial officer, said the company is “proud to be one of the first German companies to have successfully issued a blockchain-based bond”.

He said that “this makes Siemens a pioneer in the ongoing development of digital solutions for the capital and securities markets.”

“With our innovative products and technologies, Siemens supports the digital transformation of its customers with great success. It is therefore only logical that we test and utilise the latest digital solutions in finance, too.

It has been possible to issue blockchain-based digital bonds in Germany since the Electronic Securities Act came into effect in June 2021.

Siemens used the new possibilities of the Electronic Securities Act and sold the securities directly to investors without engaging established central securities depositories.

Payments were made using classic methods as the digital euro was not yet available at the time of the transaction. The transaction was able to be completed within two days.

“By moving away from paper and toward public blockchains for issuing securities, we can execute transactions significantly faster and more efficiently than when issuing bonds in the past,” said Peter Rathgeb, corporate treasurer at Siemens.

“Thanks to our successful cooperation with our project partners, we have reached an important milestone in the development of digital securities in Germany, [and] we are going to actively drive their ongoing development.”

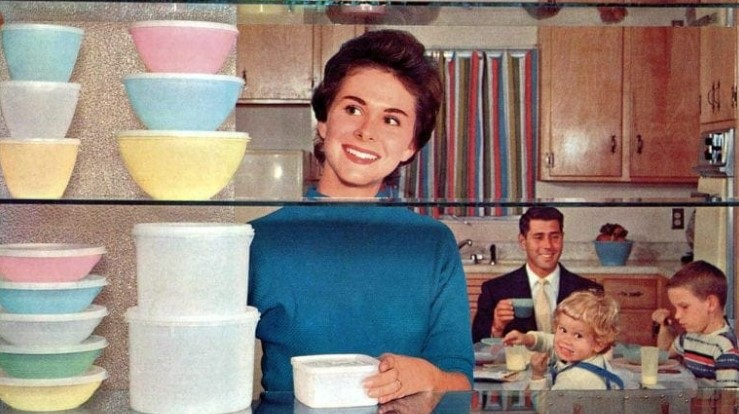

American icon Tupperware files for bankruptcy

The company has faced a decline in sales over recent years

ECB lowers key interest rates by 25 basis points in response to inflation outlook

While inflation remains high, the ECB projects it will ease in the second half of next year

HSBC Malta share price drops sharply following strategic review announcement

Market analysts suggest that the uncertainty surrounding the review, with speculation of an impending sale, has fuelled investor concerns