The local rental market is bustling with activity as growing demand bolstered by record levels of immigration have launched prices to new heights.

An assessment conducted by the Housing Authority delved into how the rental market has evolved over the past few years since the implementation of rent reform in 2020 which introduced a rent register.

“As we delve into the findings of this study, it is crucial to recognize that the rental market is not static; it is a dynamic ecosystem influenced by various factors, including social, economic, and demographic changes,” said Matthew Zerafa, CEO of the Housing Authority.

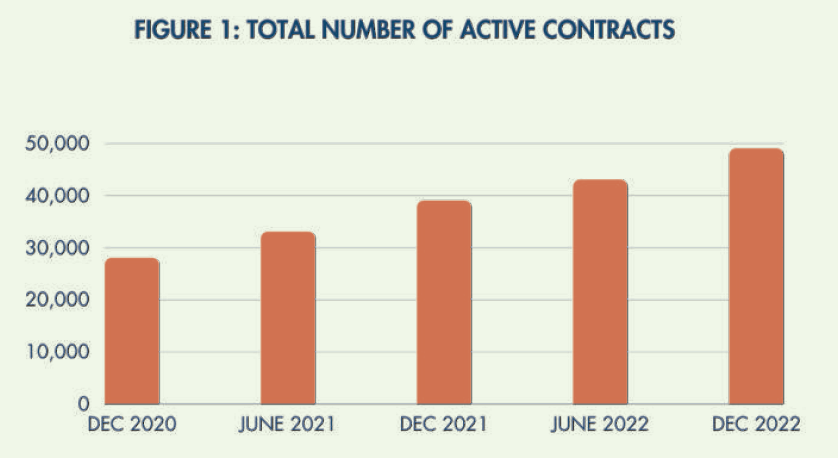

Active registered contracts stood at 47,879 at the end of 2022, a year-on-year increase of 24 per cent.

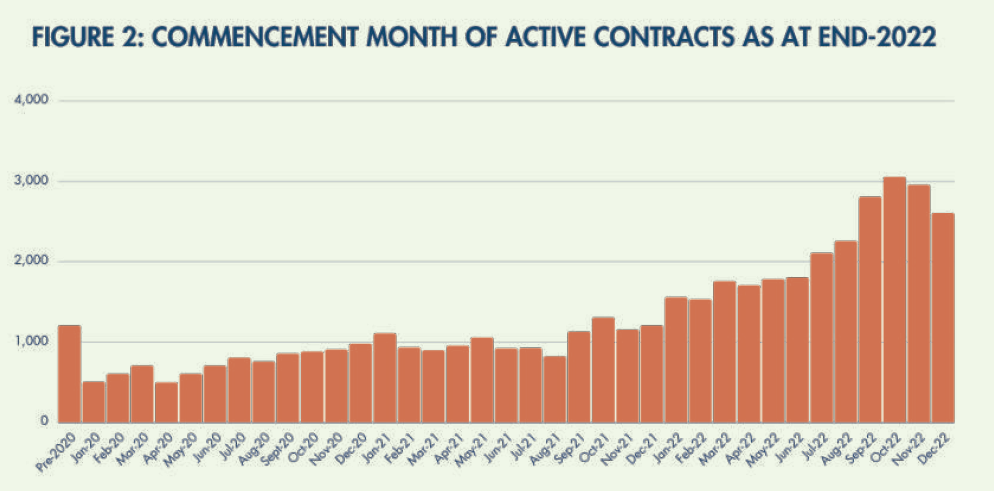

The majority of active contracts (54 per cent) were registered in 2022 alone. The rest were registered in 2021 and 2020 respectively (25 per cent and 17 per cent).

Just under 95 per cent of active contracts were long-term leases (i.e., for a duration of at least once year), with a further five per cent classified as shared spaces, and the remaining classified as short-term leases.

The Housing Authority noted that the share of shared spaces appeared quite low, considering anecdotal evidence which indicated a large degree of co-sharing among foreign workers.

In 2022 alone, the number of foreign workers in Malta grew by a whopping 20,575, increasing the total number to 96,970, the majority of whom were third country nationals.

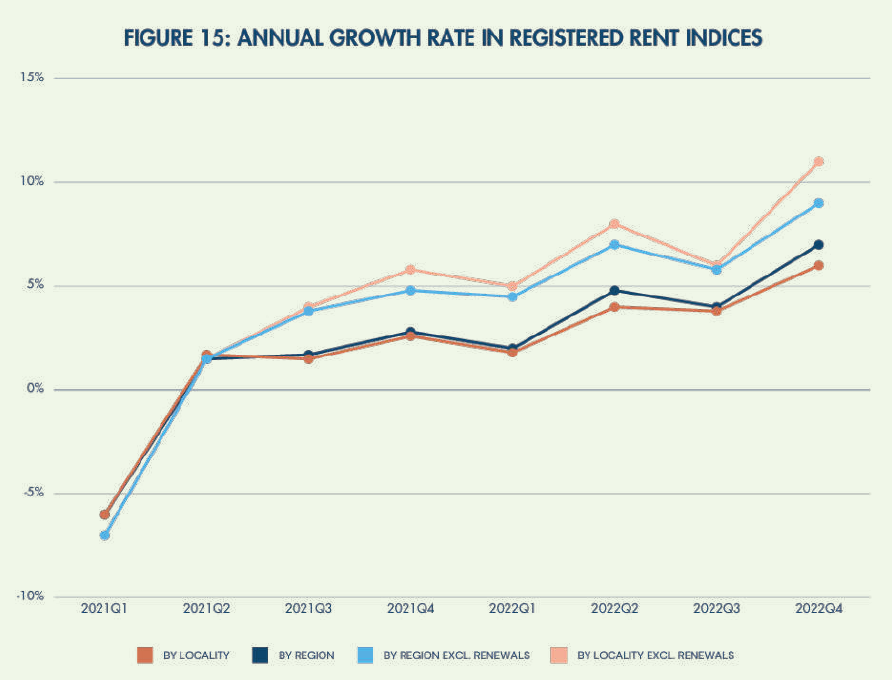

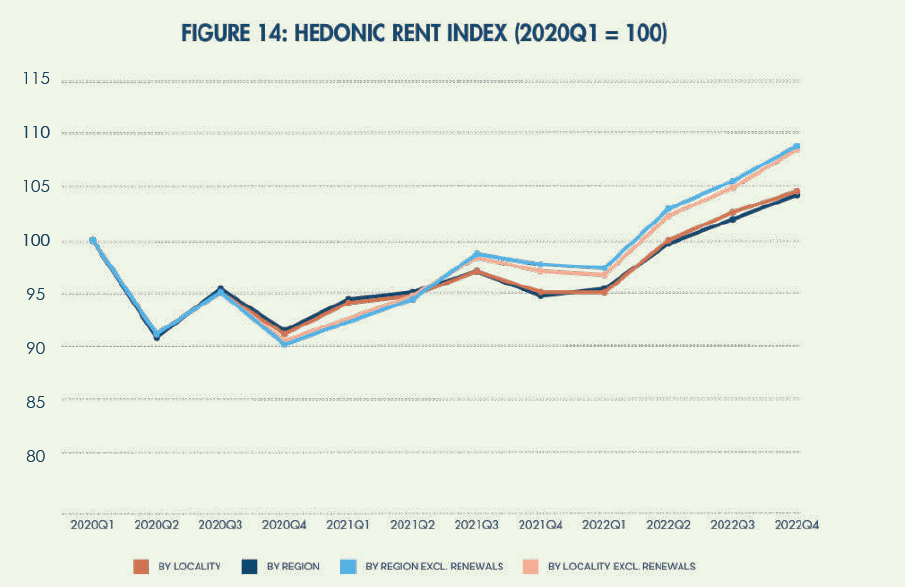

The report acknowledged that the sharp inflow of foreign workers has led to increased demand for rental accommodation and upward pressure on rents. In the second half of 2022 alone, rents increased by six to nine per cent year-on-year.

When looking at renewals, it was found that during 2022, a total of 21,529 contracts were renewed.

Almost all renewed contracts were for a period of one year, and the Housing Authority found that it contributed to stable rent prices. Upon renewal, 95 per cent of contracts maintained the same price.

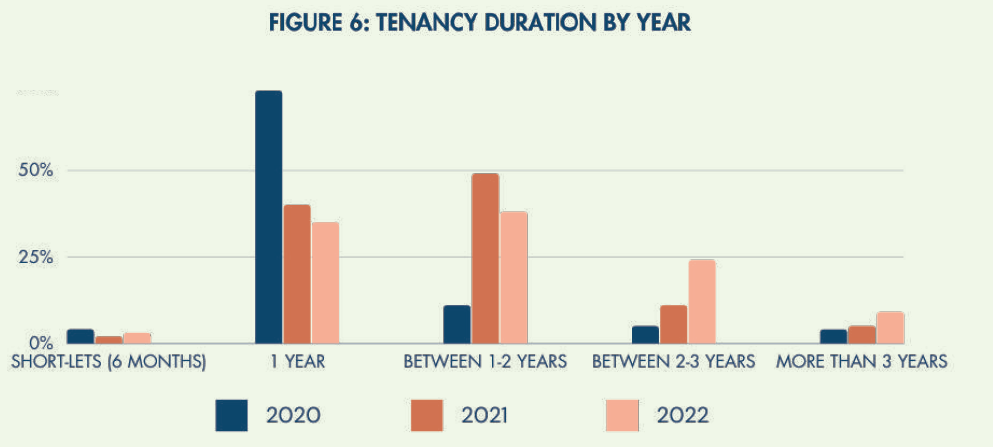

Meanwhile, tenancy duration was found to have gradually increased since the register was established. This was recorded by calculating the difference between the stipulated termination date and the commencement date of a contract.

In 2022, tenancy for a single year declined from 74 per cent in 2020, to 35 per cent. While the share of tenancies lasting between one to two years spiked to nearly 50 per cent in 2021, it fell to 27 per cent in 2022.

The growing trend appears to be in favour of even longer lets, with the share of tenancies between two to three years in length and those of more than three years in length demonstrating consistent year-on-year increases between 2020 and 2022.

As for new contracts, roughly 27 per cent of new contracts signed between July and December 2022 had a monthly rent of around €700 and €899, while 29 per cent of rents exceeded €1,000 per month.

Only around 14 per cent of contracts were for a monthly rental rate of €500 or less. However, it was noted that these appeared quite cheap compared to prevailing market rates for long-term leases, and were more line with rents charged for shared spaces.

As for shared spaces, 60 per cent of active leases in 2022 had a monthly rent between €100 and €299.

On average, between the second half of 2022 and the second half of 2021, rents increased by 6.6 per cent. If renewed contracts were excluded, that rate increased to 8.8 per cent.

The report highlighted that this illustrated the importance of renewals in maintaining more stable prices, since an existing landlord-tenant relationship lowers information asymmetry which is prevalent in new contracts.

Preferences for property remained largely unchanged, with 80 per cent of contracts being signed for apartments of either two or three bedrooms.

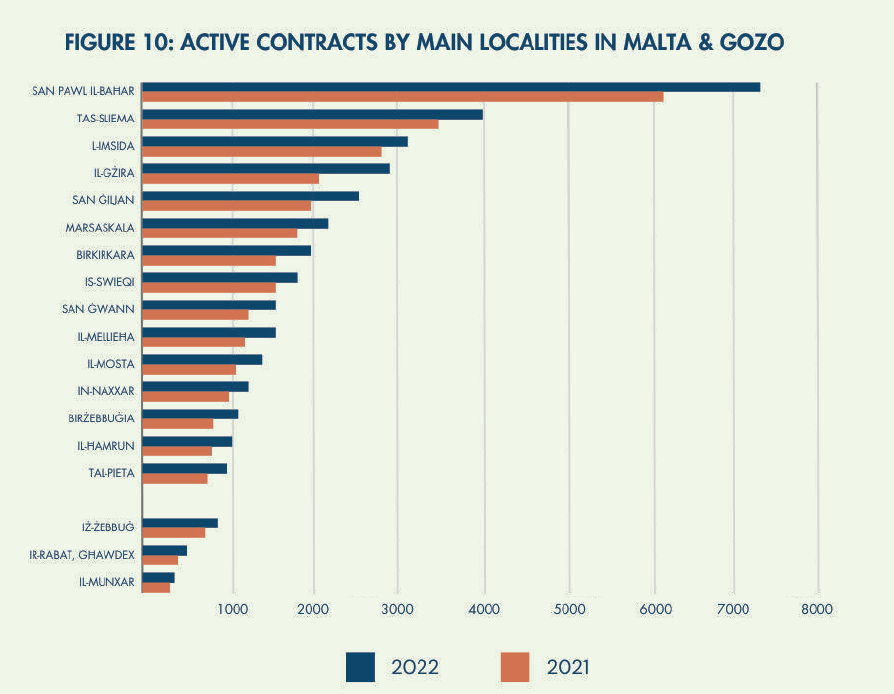

The distribution of rental contracts on a regional and local level also remained fairly unchanged.

St Paul’s Bay remained the most popular locality, being home to around 7,300 active leases in 2022. It was followed by Sliema and Msida, however, there was a significant gap between St Paul’s Bay and the rest.

Overall, the Northern Harbour region remained the most concentrated area, hosting 44 per cent of all active leases.

Gozo only accounted for 7 per cent of all active leases.

The most expensive region was identified as the Northern Harbour region, with average rental rates for a two-bedroom accomodation being €899 a month. This was followed by the Western region (€747 a month), Northern region (€696 a month), South Eastern region (€666 a month), Southern region (€640 a month).

Gozo was the most affordable region, with average rents for a two-bedroom accomodation being €562 a month.

The report identified two issues which merited further investigation, the low share of contract for shared spaces, and the large share of rents below €500 for long-term leases. It was theorised that these might be attributed to the restrictive regulatory conditions for shared contracts.

Two years since its birth, Moneybase features on Microsoft’s Customer Stories

Moneybase has now just been featured on Microsoft’s latest Customer Stories

Finance Minister confirms continuity of food and energy subsidies

Spending on food and energy subsidies as a percentage of the GDP will be at 0.7% in 2025

MHRA congratulates Glenn Micallef on EU role, highlights positive impact on Malta’s tourism and cultural sectors

The lobby group emphasised that Malta’s cultural assets and sports scene are key factors in attracting visitors and fostering economic ...