Just four years ago, anyone interested in assessing the state of the private rental market in Malta would have stumbled onto a problem – the absence of official statistics on this sector. It is difficult to conduct a meaningful assessment if even the most basic information, like the number of active rental contracts or the market rent by property type, size and locality are not available. All this despite the increasing importance of this sector in housing a growing segment of the population, especially the foreign workforce.

The introduction of the Private Residential Leases Act in 2020 led to the establishment of a rent register that is continuously updated, yielding an invaluable source of information. Since then, the Housing Authority has published several studies on the private rental market in Malta, and starting from last year, increased the frequency of its rent publications to twice per year.

Latest developments in the rental market

Our latest update, covering the second half of 2023, reveals several interesting trends. The number of active contracts registered with the Housing Authority rose to more than 60,000 by the end of 2023, an increase of 23 per cent compared to a year earlier. In 2020, active contracts stood at 27,727. The increase in this sector is reflective of the strong population growth, driven by foreign workers, which tend to rely heavily on rental housing for their accommodation.

The type of properties for rental accommodation has remained very similar since the establishment of the register although recently the share of houses has been rising. Apartments constitute slightly less than 80 per cent of rental properties. In terms of size, while two-bedroom dwellings remain the most prevalent, we are starting to observe an increase towards larger properties (i.e., with four bedrooms or more). This is consistent with the observed increase in shared space contracts.

Rental accommodation is becoming increasingly diffused across the island and there are now 17 localities, including one in Gozo, with more than 1,000 active contracts. St Paul’s Bay retains the top spot, with slightly less than 8,900 rental contracts at the end of 2023. Other popular localities for rental housing include Sliema, Msida, Gżira, St Julians, Marsaskala, Birkirkara and Swieqi.

Renewals and tenancy duration

Our report finds that there were more than 25,700 renewals in 2023, a record since the establishment of the register. While most of these consisted of automatic renewals, around 92 per cent were renewed with the same rent, in line with the trend observed in past years. Renewals help to maintain stable rents since they remove the information asymmetry between landlords and tenants that is prevalent at the start of the contract.

This finding is consistent with the results of a survey held with landlords and tenants that we published earlier this year, in which we found that around three out of every four landlords expressed a high willingness to extend the contract with their current tenants. It is encouraging to note that 19 per cent of renewals in 2023 have been renewed twice.

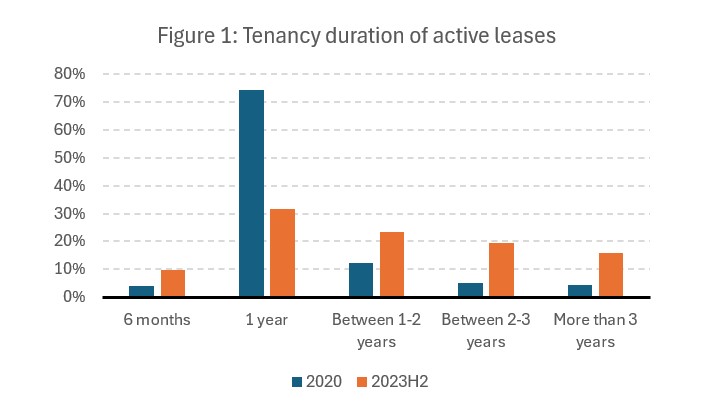

As a result of contract renewals, we have witnessed an increase in the tenancy duration. The latter is computed as the difference between the stipulated termination date of the contract and its commencement date. In 2020, around 75 per cent of rental contracts had a duration of one year, representing the popularity of one-year contracts in Malta. Since then, the share of contracts with a longer duration has gradually risen and, at the end of 2023, tenancies with a duration longer than three years amounted to 16 per cent of all active leases.

Rental prices

Around a third of long-let contracts signed in the second half of 2023 had a monthly rent between €700 and €999. The share of contracts exceeding €1,000 per month stood at 38 per cent. Meanwhile, 70 per cent of shared space contracts signed during this period came with a monthly rent below €300.

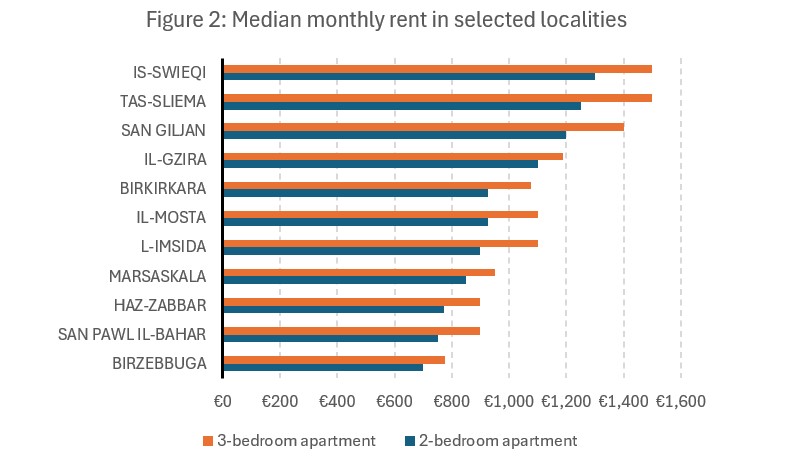

There are significant variations in rents by locality and size of dwellings. Figure 2 shows the median monthly rent for two- and three-bedroom apartments in selected localities for long-let contracts that started in the second half of 2023. The most expensive rents are found in the localities of Sliema, Swieqi and St Julian’s. In St Paul’s Bay, the median monthly rent for a two-bedroom and three-bedroom apartment stood at €750 and €900, respectively. In Sliema, similar-sized units go for €1,250 and €1,500, respectively. In Birkirkara, the rent for a two-bedroom apartment stood at €925 per month, whereas in Marsascala, a similar-sized apartments costs €850 per month. This information is crucial for any assessment of rent affordability in Malta.

Our hedonic indices suggest that rents rose by 4.8 per cent in the second half of 2023 compared to a year earlier. This estimate tends to be more muted compared to the growth rates calculated from advertised rents. In addition to composition differences in the data sources, a key distinction between registered and advertised data is that only the former takes into consideration contract renewals, which tend to keep the same rent.

In the coming weeks we plan to launch a dashboard that makes this information readily available to the public. This project, which is part of the Authority’s ambitious digitalisation agenda, is a testament to our commitment to continue to rely on a data-driven approach to make evidence-based decisions and enhance price transparency to the benefit of all stakeholders in this sector.

Another takeover bid in Malta

Edward Rizzo says that one cannot exclude other takeovers taking place across the Maltese capital market in the near future

Two years since its birth, Moneybase features on Microsoft’s Customer Stories

Moneybase has now just been featured on Microsoft’s latest Customer Stories

Finance Minister confirms continuity of food and energy subsidies

Spending on food and energy subsidies as a percentage of the GDP will be at 0.7% in 2025